Watchlist: WLT WFR HR IVN APWR INFY SGR AIG PPDI

First, to focus on the positive, I was net $165 or so on the week. By far my best 5 days of trading and a nice start for July.

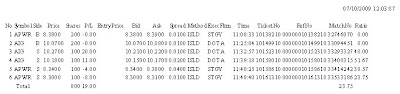

| Stock | Shares | Gross | Fee | Side | Net | Set-Up | Actual |

| APWR | 200 | -12 | -2.71 | Long | -14.71 | Bot-Bou | Mixed |

| AIG | 200 | 31 | -1.71 | Long | 29.29 | ORH-BO | ORH-BO |

| $14.58 |

UPDATE: Wow, AIG really took off from my $10 entry, almost kissing $12! Pulling the trigger and letting winners run….continue to have to be my focus.

Just another off day. Today I had a ton of uncompleted orders, both because I never started them or I hesitated a bit and price moved away from my limit price. To be honest, I probably prevented losses nearly as much as missing some winners today, and I have to remember that, it was more prevalent today than I can remember before.

Trading is a performance activity – like a sport. You can do lots of planning and prep, and post action review. But it’s what you do in the moment – on the field or court – at clutch time. This is a mental issue I need to grapple with.

AIG – I made some money off of it today, but left a bunch on the table. On the trade, I took my partial profit properly but didn’t let the rest run to what would of been my next price target of $10.50. It’s knocking on $11.00 right now! My first instinct was to short AIG around $9 and that was one of my un-started orders, and one of the losses I missed by hesi-trading. But I passed going long at $9.45ish, and then shorting on the rocket candles right after it first blew past $10.00. Finally got in on the retake of $10.00 with volume and bullish level two action.

APWR – Not a great set-up, price was in no-where land not near a solid whole number or ORH / ORL. I saw some volume there that would help with a bounce but I got caught in a range. I helped drive the price to the bottom of the range through a market order and got lousy fills on my exit.