Gold has been stealing the spotlight the past few months, but softs have been soaring. Sugar and cocoa are trading at their highest levels in nearly three decades, and coffee is trading within reach of a 10-year high. These markets have seen sizable gains, but that doesn’t mean they can’t continue to continue moving higher.

Coffee Outlook

Coffee can be a tricky market to follow. It’s very supply-demand driven and can be quite volatile. Over the past year, this market has seen a substantial downturn in production and in stocks readily held. ICE certified coffee stocks were at 3.15 million bags in the fourth quarter of 2009, down 30 percent from 2008. Coffee stocks can fluctuate 5 or 10 percent, but 30 percent is huge.

USDA world production for the 2009/2010 season has been forecast at 125.2 million bags, down 10 percent from last year. Brazil, Vietnam and Columbia produce more than 50 percent of the world’s coffee, with Brazil being the dominant producer. Growers in Brazil and Columbia expect 2009 production to fall nearly 30 percent from last year, which would result in one of the smallest crops in 35 years. These are bullish fundamental reasons for continued gains.

The Commodity Futures Trading Commission’s Commitments of Traders report for the week of December 15, 2009 showed the funds have been strong buyers. Open interest increased to 105,659 and has been in an uptrend since late November. This market is dominated by commercial players who can move in and out of the market often and dictate price action.

The call/put ratio is also an indication of how bullish sentiment is for coffee. It has moved from 1.6 to 2 since early November. This shows two calls have been traded for every one put.

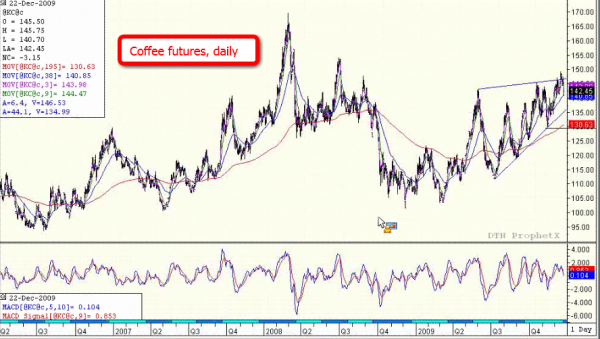

The technical picture confirms the bullish fundamentals for coffee. The large peak in 2008 in the middle of the chart was followed by a large drop in three waves, then the market consolidated and built a base. On the far right side of the chart, there is a pennant or wedge formation, and I believe we are potentially in wave four of classic Elliott Wave analysis, which I believe should result in a burst higher out of the top of the range.

As a cautionary note, there is not a confirmation in the moving average convergence divergence (at the bottom under the chart), which is a negative. But that doesn’t negate the formation. While no one can know for sure which way the market will go, as long as the market stays in this formation, I think the trend should remain bullish.

In the 1980s and 90s, coffee saw some huge spikes tied to weather in South America, which you can see on the next chart. We haven’t had a weather spike that dramatic for well over a decade. Why? Many of the farmers in South America moved their planting away from frost-prone areas on the mountainsides and into the valleys.

I see a market that still could have a long way to go. Those spike highs from past decades are attainable—who’s to say it couldn’t happen again for some reason? It’s not easy for wait for those types of spikes to happen, but you can set up positions in case fundamentals set up for a big move.

Trading Strategies

Coffee is volatile, and you need to have sufficient capital to trade it profitably. If you get it right it can be very rewarding, and if you get it wrong, it can be painful. This is an exciting time of the year to trade this market, as we are in the South American growing season.

One of the easiest strategies is to buy the breakout in coffee. I would wait for a close though $1.50 a pound in coffee, and perhaps we’ll see the fifth wave (or the c part of an a-b-c move) and an explosion higher. I think the professional traders are likely to press this trend as far as they can, and I could see 40 or 50 cents of further upside in coffee.

You could consider buying March coffee futures at current levels and risk a move to $1.39. A move under $1.40 would create a possible deeper correction, and not worth risking. You could also buy March coffee, and sell a 155 call for four cents or better (covered call). The premium you capture from selling the call provides a cushion and gives you more room to stay with the trade without getting stopped out too soon. You only are in a losing position if coffee moves under $1.38.

You could also consider a bull call spread, buying May coffee 150 calls and selling 160 calls for about 3.5 cents. These options expire in early April. This is a more limited-risk way to approach the market, and gives you time if the market goes nowhere for a few months.

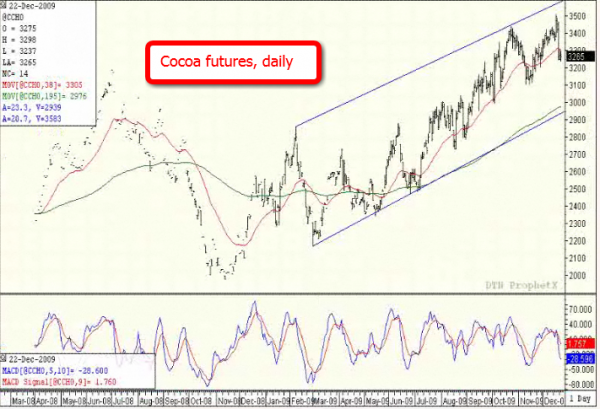

Cocoa

Cocoa shows a classic stair-step bull market, moving up in three-count waves. We are at the stage right now where we could be seeing the top, but the picture is still bullish from a fundamental standpoint. This market has been influenced by supply/demand issues as well as U.S. dollar weakness.

Sugar

Sugar is in fact the best-performing commodity of the decade, surging due to weather issues (too much rain in some growing regions, too little in others). The chart also shows a beautiful base-building event. We had a lengthy period of sideways action before sugar really took off. We see another classic Elliott Wave cycle, with a wedge/triangle and wave four culminating in a possible wave five. Supplies are tight due to weather problems, and the market is feeling it. The fund participants in the market may try to push this farther than it needs to go.

I see the big straight up move, then a sideways move, and I think from a technical standpoint that the market should burst higher. However, we don’t see a confirmation on the moving average, which is a sign of caution. The objective is not really to pick the tops in these markets, but to find opportunities to trade them.

U.S. Dollar

The caveat to the bullish outlook in commodities is the U.S. dollar. Many commodities are priced in dollars, and they tend to have an inverse relationship to the dollar. If the U.S. dollar continues to strengthen, it would likely cause breakouts to fail. The ICE Dollar Index futures need to get past congestion near 81 – 82 to break the bearish overall trend. If this market moves beyond these levels, that could depress commodity prices. But if the dollar trades sideways for a while, that leaves softs markets free to potentially follow their own path, and focus on pure supply and demand fundamentals.

In sum, as long as the dollar doesn’t make a sharp move higher, I think the outlook for these markets is bullish and there is time for these trades to work.

Please contact me with any questions you have about this topic or the markets, and to develop a custom trading strategy based on your particular situation.

Andrew Vallance is a Senior Market Strategist based in Toronto, and is serving clients in Canada. He can be reached at 416-369-7948 or via email at avallance@lind-waldock.com. You can follow Andrew on Twitter at www.twitter.com/LWAVallance.

The data and comments provided above are for information purposes only and must not be construed as an indication or guarantee of any kind of what the future performance of the concerned markets will be. While the information in this publication cannot be guaranteed, it was obtained from sources believed to be reliable. Futures and Forex trading involves a substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. Please carefully consider your financial condition prior to making any investments. Not to be construed as solicitation.

Futures trading involves substantial risk of loss and is not suitable for all investors.

Lind-Waldock, a division of MF Global Canada Co. Toll-free 877-501-5463. MF Global Canada Co. is a member of the Investment Industry Regulatory Organization of Canada and Canadian Investor Protection Fund.

Futures Brokers , Commodity Brokers and Online Futures Trading . 123 Front St. West, Suite 1601, Toronto, Ontario M5J 2M2.

© 2009 MF Global Ltd. Lind-Waldock promises never to sell your information to anyone.