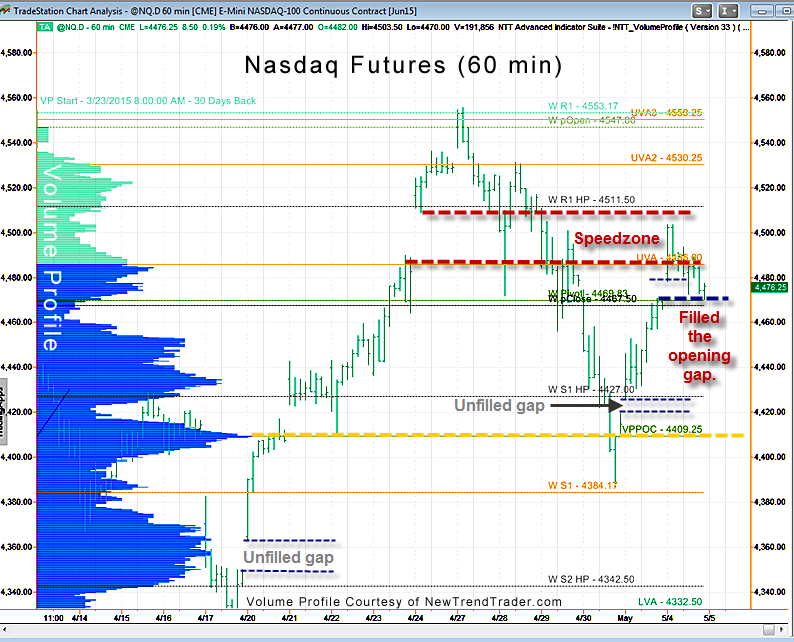

The Nasdaq futures ended last week at the Weekly Pivot (4469). Weekly pivots represent a balance point.

Then, we opened with some enthusiasm on Monday, gapping up about 13 points, and proceeded to advance into the Speedzone, as noted yesterday on the Volume Profile chart. This is a price range where we had a previous gap and it makes for fast movement when revisited, since markets have memory.

Despite the quick morning rally, the Nasdaq futures fell back to earth and closed more or less at the Weekly Pivot. No ‘progress’ was made, but this is actually a bullish development, since by filling the opening gap an important piece of housekeeping has been proactively addressed. (Unfilled gaps weaken rallies.)

For the gap police, we now have two remaining fugitives: 4419 and 4349. While the market would strengthen itself by filling these sooner than later, the close above the Weekly Pivot means that selling pressure is modest.

Icarus fell back to earth, but he had a soft landing.

###

A Note on Volume Profile

The histogram on the left side of the chart shows the volume distribution in the Nasdaq futures for different periods of time. Key support and resistance levels are indicated by the peaks and troughs. If you would like to receive a primer on using Volume Profile, please click here: www.daytradingpsychology.com/contact

Related Reading: