October sugar closed down 8 points at 21.92 cents yesterday. Prices closed nearer the session high yesterday and were pressured on mild profit taking. The major runaway bull market in sugar continues. Would-be top-pickers do not want to stand in front of this market. Bullish fundamentals and technicals are fueling the advance. The sugar bulls still have the solid near-term technical advantage. Prices are still in a nine-month-old uptrend on the daily bar chart. Bulls’ next upside price objective is to push and close prices above technical resistance at 24.00 cents. Bears’ next downside price objective is to push and close prices below solid technical support at 20.00 cents. First resistance is seen at yesterday’s high of 22.20 cents and then at Monday’s contract high of 22.44 cents. First support is seen at 21.50 cents and then at yesterday’s low of 21.25 cents.

Wyckoff’s Market Rating: 8.5

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

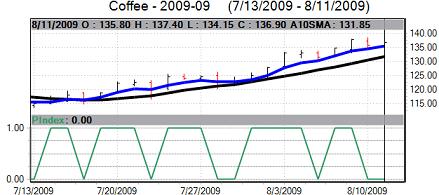

September coffee closed up 105 points at 136.90 cents yesterday. Prices closed nearer the session high yesterday. The key “outside markets were mostly bearish for coffee yesterday, as crude oil prices were weaker and the U.S. stock indexes were weaker. That did limit buying interest in coffee. Bulls still have the solid near-term technical advantage. Prices are in a four-week-old uptrend on the daily bar chart. Coffee bulls’ next upside price objective is pushing and closing prices above solid technical resistance at the June high of 144.80 cents. The next downside price objective for the bears is closing prices below solid technical support at 128.00 cents a pound. First support is seen at 135.00 cents andthen at yesterday’s low of 134.15 cents. First resistance is seen at this week’s high of 138.60 cents and then at 140.00 cents.

Wyckoff’s Market Rating: 7.0

September cocoa closed down $82 at $2,817 yesterday. Prices closed nearer the session low. The key “outside markets were mostly bearish for cocoa yesterday, as crude oil prices were weaker and the U.S. stock indexes were weaker. Cocoa bulls still have the near-term technical advantage. However, still overhead resistance does lie overhead at last week’s high of $2,964. The next upside price objective for the cocoa bulls is to push and close prices above solid technical resistance at the August 2008 high of $2,973. The next downside price objective for the bears is pushing and closing prices below solid technical support at $2,729. First resistance is seen at $2,850 and then at yesterday’s high of $2,904. First support is seen at

yesterday’s low of $2,792 and then at $2,780.

Wyckoff’s Market Rating: 7.0.

December cotton closed up 25 points at 64.00 cents yesterday. Prices closed nearer the session high yesterday and hit another fresh three-week high. Concerns about a hurricane hitting the U.S. cotton crop in the coming weeks have added to speculative buying interest. The cotton bulls have the near-term technical advantage. The next downside price objective for the cotton bears is to produce a close solid technical support at 60.00 cents. The next upside price objective for the bulls is to produce a close above solid technical resistance at the July high of 64.98 cents. First resistance is seen at yesterday’s high of 64.14 cents and then at 64.50 cents. First support is seen at 63.50 cents and then at 63.00 cents.

Wyckoff’s Market Rating: 6.5.

September orange juice closed up 445 points at $1.1125 yesterday. Prices closed near the session high and hit a fresh 10-month high again yesterday. Fresh speculative buying has hit the FCOJ market amid talk of hurricanes brewing in the Atlantic Ocean, which could threaten a Florida orange crop that is already perceived as being a short one this year. The bulls have the solid near-term technical advantage. However, the market is now short-term overbought, technically, and due for a corrective pullback soon. The next downside technical objective for the FCOJ bears is to produce a close below solid technical support at the July high of $1.0485. The next upside price objective for the OJ bulls is pushing prices above solid technical resistance at $1.2000. First resistance is seen at yesterday’s high of$1.1160 and then at $1.1250. First support is seen at $1.1000 and then at

$1.0800.

Wyckoff’s Market Rating: 8.0.

September lumber futures closed up $2.70 at $193.70 yesterday. Prices closed near mid-range and were supported on short covering in a bear market. Bears have the solid near-term technical advantage. The next upside technical objective for the lumber bulls is pushing and closing prices above solid technical resistance at $205.00. The next downside price objective for the bears is pushing and closing prices below solid support at the contract low of $179.00. First resistance is seen at yesterday’s high of $196.00 and then at $200.00. First support is seen at yesterday’s low of $189.80 and then at $187.00.

Wyckoff’s Market Rating: 2.5.