EUR/USD

The Euro remained under pressure in Asian trading on Monday and dipped to test lows below the 1.19 level against the dollar which was a fresh four-year low for the currency.

The currency attempted a limited recovery in European trading with some correction from over-sold conditions after the very sharp losses seen during Friday’s session. The Euro-zone industrial data also provided some degree of support for the Euro with a further 2.8% rise in German industrial orders for April following a revised 5.1% increase in orders the previous month.

There will be further speculation that German industry will gain support from an improvement in competitiveness following a sharp decline in the Euro and this may help underpin growth expectations.

Government officials also attempted to revise their comments on Friday that Hungary could default on its debts. Nevertheless, the Euro was unable to regain much ground as underlying sentiment remained extremely negative. There were further stresses within the bond markets has structural fears persisted. There were also a further round of rumours with some speculation that Germany could decide to leave the Euro area.

The Euro was unable to regain the 1.20 level and retreated to 1.19 later in the US session as Wall Street came under fresh selling pressure and the dollar gained some renewed support on defensive grounds.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Risk conditions remained the dominant influence on Monday and the Nikkei index suffered its sharpest one-day decline for 14 months. With commodity prices also weaker, selling interest in the yen remained limited.

There will be further speculation over government opposition to yen gains and this will deter buying to some extent. The dollar dipped to test support below 91 before stabilising while the Euro weakened to fresh 9-year lows near 108.

The US currency was able to resist further losses during the day with the yen hampered by a lack of yield support and a lack of confidence in the domestic fundamentals.

Sterling

International risk dominated again on Monday with the UK currency weakening to lows near 1.44 against the dollar before finding support while Sterling was again resilient against the battered Euro.

Prime Minister Cameron warned over the need for substantial government spending cuts to help stabilise the budget situation over the medium term. The comments had a mixed Sterling influence with fears over the impact on demand within the UK economy offset by relief that the government was serious about tackling the deficit. There was some also speculation that Sterling was gaining support from a switch out of German and Euro-zone bonds which curbed selling pressure.

Risk conditions remained important and a tentative rally in conditions help the UK currency back above 1.45 before some renewed selling later in the US session as equity markets came under renewed selling pressure. The UK currency strengthened to fresh 18-month highs near 0.8280 against the Euro before hitting some profit taking.

Uncertainty over the Bank of England’s monetary policy will maintain the potential for erratic Sterling moves ahead of Thursday’s MPC policy meeting.

Swiss franc

The dollar found support below 1.16 against the franc during Monday, but was unable to make a challenge on levels towards 1.17 as the dollar was again hampered by general franc strength on the crosses. The Euro was unable to make any significant impression and consolidated around 1.39 against the Swiss currency.

The franc again secured significant support from a lack of confidence in the Euro-zone area, especially with a further increase in bond spreads on Spanish bonds over German bunds. This situation is liable to prevail in the near term with a lack of underlying confidence in the Euro area. In this environment, National Bank policy intentions will remain a key focus.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

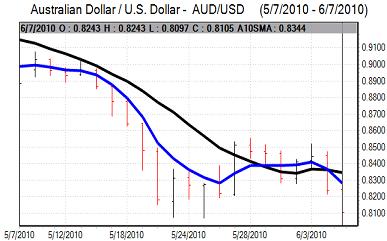

The Australian dollar hit fresh June lows near 0.81 against the US currency in local trading on Monday. There will be unease over the domestic economy and risk appetite is likely to remain much more fragile in the near term. The Australian dollar will be particularly vulnerable to fears surrounding the global growth outlook and the potential impact on commodity prices.

The Australian dollar rallied during the US session, but was unable to break any major resistance levels and retreated back to lows near the 0.81 level later in the US session as Wall Street was subjected to further selling pressure.