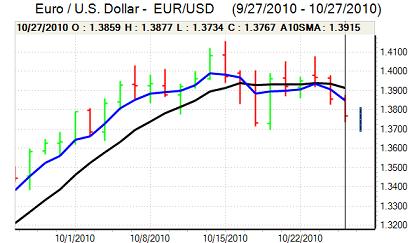

EUR/USD

The Euro remained on the defensive during Wednesday with some improvement in dollar sentiment and a re-emergence of Euro-zone doubts.

The Greek Finance Ministry stated that revenue growth had been weaker than expected during 2010 which will make budget deficit compliance even more difficult while there were also reports that Portugal’s 2011 budget negotiations had broken down. The Euro will remain vulnerable if there is any further widening of internal yield spreads.

The headline US durable goods data was stronger than expected with a 3.3% gain for September, but the underlying figure excluding erratic transport orders was weaker than expected with a 0.8% monthly decline and there was a generally weak tone in capital spending.

New home sales rose to an annual rate of 307,000 from a revised 288,000 the previous month and was broadly in line with the existing sales data released previously.

There was continuing discussion surrounding Fed policy intentions during the day with further expectations that the Fed would take more cautious tone towards a second round of quantitative easing, although uncertainty remained high.

There was a rise in US Treasury yields to the highest level for 5 weeks which also triggered some improvement in dollar demand. The Euro weakened to a low around 1.3730 before rallying back to just above 1.38 with the dollar still finding difficult to secure strong buying support.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar maintained a firm tone on Wednesday and tested resistance levels above 82 against the yen before hitting significant profit taking after a strong run over the previous 24 hours. The US currency continued to draw some underlying support from a rise in US bond yields.

The Japanese economic data did not have a significant effect with retail sales rising 1.2% over the year as markets remained focussed on global monetary policies.

The Bank of Japan left interest rates in the 0.0-0.1% range following the latest policy meeting and announced no new measures. The next meeting has, however, been brought forward to next week which suggests that there is the possibility of co-ordinated action following the FOMC meeting next week. The dollar drifted weaker to the 81.50 area following the Bank of Japan meeting.

Sterling

Sterling maintained a firmer tone against the Euro on Wednesday , but was unable to strengthen through the 0.87 level while a generally firm US dollar tone prevented any significant Sterling advance against the US dollar as it found support on dips towards 1.5750.

The UK currency was still gaining support from the GDP release the previous day with reduced expectations of an immediate expansion of the quantitative easing programme and some speculation that there could be an earlier than expected increase in interest rates. MPC member Posen remained very cautious over the economic outlook, but he will tend to find it more difficult to convince a majority to back his view.

There will still be expectations of a slowdown in the economy and sentiment could reverse rapidly if there is evidence of a sharp deterioration in business confidence.

Swiss franc

The dollar pushed to a high just above 0.99 against the Swiss franc during Wednesday and maintained a firm tone even though there was pressure for a correction following a strong advance over the previous 24 hours. The franc was also generally weaker against the Euro although there was support close to 1.37.

There will be further expectations of a slowdown in the Swiss economy which will sap franc strength to some extent. There will also be expectations that the National Bank will be quietly encouraging a weaker currency.

The franc will, however, tend to gain fresh buying support if there is any return of Euro-zone bond market stresses and overall selling pressure is still likely to be limited.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

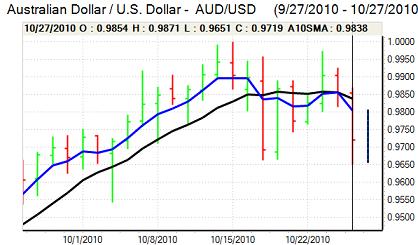

Australian dollar

Following a very sharp retreat following the consumer inflation data, the Australian dollar found support below 0.97 and corrected back to the 0.9750 area.

There is still the possibility of an interest rate increase next week which curbed immediate selling pressure on the local currency with solid buying support on dips.

There will be further speculation over a slowdown in the Chinese economy as well as persistent fears over the G7 outlook which will tend to dampen Australian dollar support.