By: Scott Redler

Investors Business Daily finally changed their Big Picture to “Cautious Confirmed Uptrend.” If you’ve been reading my notes, I have been cautiously buying since we had our reactionary reversal on Friday, February 5th at around 1,044 on the S&P. I will save everyone the flashbacks, as I have been trying to give a play-by-play every morning.

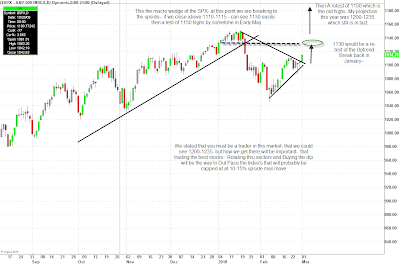

The S&P broke its wedge to the upside. Today we are opening near 1,120, with big resistance checking in at 1,130. I do think we test that level this week! Then, at some point, if the composure stays in tact, a move through the old highs of 1,150 should happen by MAY.

- Apple (AAPL)–has come a long way since last Thursday’s reversal. $202 was the new technical buy price and now the stock is opening up on it’s attempted fourth consecutive up day. $210-215 is a big resistance area. It would be better to rest a bit and consolidate before breaking out to new highs in the coming weeks. I have been trading AAPL from a macro long stance–which I maintain–BUT TODAY, I will look for a cash-flow short if I see a negative divergence.

- Amazon (AMZN)–Was the rock star trade yesterday. $119.75 and $121 were the prices to buy. My short-term target was $124-125, and we hit that yesterday. So, I will not focus here for now as it could be choppy, but we should be seeing $130 sooner rather than later.

- Baidu (BIDU)–at new highs. It’s hard to be long, hard to be short. I will continue to avoid it.

- Google (GOOG)–is popping back into its lower range. It’s not good to trade unless we see some type of resolution with China and HUGE HUGE volume. There are far better stocks to focus on right now.

- Research in Motion (RIMM)–STILL LOOKS GOOD. I will go after this one if it can trade through $72 and HOLD $72 for a move into its gap. This one has a potential target of $77-79.

- Palm (PALM)–below $6 I think you are safe to accumulate this piece of JUNK. If it gets any cheaper, you will see “takeover speculation.” After a move from $14 to $6 in no time, I felt compelled to start nibbling yesterday.

- Qualcomm (QCOM)–I started talking about this stock at around 3:30 yesterday. I took a bit home to track the close and got lucky with some afterhours news. BUT, I would rather have had another down day in order to enter the position with size. Today I will be looking to buy a dip intraday.

- Microsoft (MSFT), Cisco (CSCO) and Intel (INTC)–All are decent if you need to just “put capital to work.” They will see new move highs this year.

- MY THREE AMIGOS (last month I stated that these will all make new highs on the year).

- Cree (CREE)–has provided great trades. It’s at new highs and is a bit extended. There is no real long setup right now. I might look for a scalp short today after such an extreme move.

- VMWare (VMW)–This one is finally over $50–it’s a slower mover, but it’s at new highs. I have been long from much earlier and will sell some into this open, but not get short.

- Intuitive Surgical (ISRG)–yesterday this was my play of the day. The stock had a great breakout above $350. Take a look at the chart and you will see exactly what I mean. The easy trade is now over.

- The Financials:

- JP Morgan (JPM)–is the new leader. It could use a bit of a rest right here. I would let it reset.

- Bank of America (BAC)–nice bounce as well, but might have some pressure with the government selling its warrants.

- Wells Fargo (WFC)–I nibbled on some yesterday and will buy more through $27.60.

- Goldman Sachs (GS)–This one is lagging big time. I would listen for headlines. If they get some resolution to the “Greece Inquiry” then it could get a big move. The buy are is around $157.50 with VOLUME. If this were to happen, I think FAS will blast through $76.50.

- Gold–last Thursday I sent a note that I bought gold for the first time with GLD at $107.10, DGP at $2610. Personally, I will look to add small if GLD can get and stay above $110.20 and trade it. This one looks good.

- The Casinos look decent. I did nibble on MGM (MGM) yesterday at $10.55 and will add through $10.80. I see a nice descending channel building. With more time, we could get more upside. Las Vegas Sands (LVS) looks very similar.

- Freeport McMoran (FCX) and U.S. Steel (X) have all met my targets. X cleared my buy price yesterday–a midlevel base at around $53.50–it could still get to $56. FCX has not yet. I might consider a buy through $77 to see it clear the midlevel consolidation and follow X’s footsteps.

- The agricultural stocks are back in play today. Monsanto (MON) did a RedDog reversal yesterday. It could be worth a bounce buy. The CF Industries (CF) for Terra (TRA) talks are back on. We might get some action in the sector.

- China Agritech (CAGC) has been a rock star. Great trades lately. I will look for a small short today as it’s very extended on its fourth upday.

In Conclusion, today could be tricky, as on Thursday we were as low as 1,086 on the S&P and now we are opening near 1,120. So, even as I think we go higher this week, this 3-4th UP day for most stocks and the indices will be tricky to maneuver today.

.png)