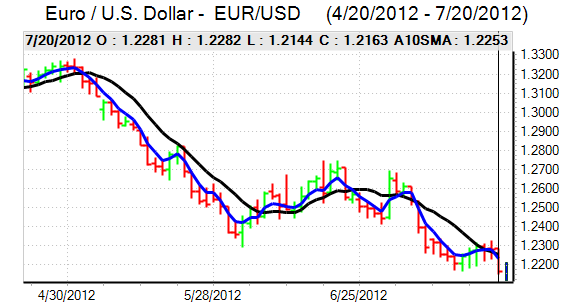

EUR/USD

The Euro was unable to make any further attack on the 1.23 region against the dollar in European trading on Friday and was subjected to heavy selling pressure. Spain was an extremely important market focus as confidence in the economy deteriorated rapidly. There were reports that the Valencia would apply for bailout funds from the central government which reinforced fears surrounding regional government finances.

The Eurogroup meeting did formally agree the EUR100bn bailout for the Spanish banking sector which provided only brief relief for sentiment and the Euro. In the formal agreement for the banks, there was a further downgrading of the GDP forecast with recession expected to continue in 2013 as GDP was expected to fall further, increasing budget fears.

There was a sharp increase in Spanish yields as spreads over German bunds widened to a fresh record high. In this context, there was further speculation that Spain would also move to a sovereign bailout which would have a huge negative impact on the Euro.

There was no relief in the negative headlines during the weekend. The IMF which is a key part of the Troika due to start its latest Greek assessment on Monday indicated, indicated that there would be no further funds for Greece. German vice Chancellor Roesler also stated that it was very unlikely that Greece would meet its commitments.

There was increased speculation that the Euro would be used as a funding currency as it dipped to fresh record lows against the Australian dollar. There were also expectations that the ECB would come under even greater pressure to relax monetary policy further.

The latest IMM positioning data recorded a further increase in long US dollar speculative positions which may limit the scope for further selling, especially with speculation that the Federal Reserve will move to additional quantitative easing. The Euro lost support in the 1.2150 area during US trading on Friday and retreated further to lows near 1.21 during the Asian trading on Monday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

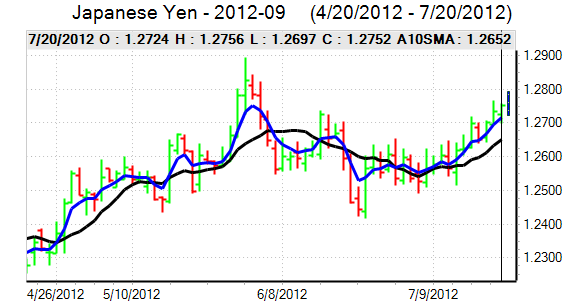

Yen

The dollar was blocked just above the 78.50 area against the yen on Friday as the Japanese currency continued to gain underlying support on the crosses.

There was a further deterioration in risk appetite which helped underpin the Japanese currency, especially with reduced confidence in the regional economic outlook which lessened any yen selling. The government left its economic assessment unchanged, but warned over the impact of a weaker global economy.

Global equity markets remained firmly on the defensive on Monday with the Nikkei index weakening to the lowest level for five weeks. The dollar weakened to lows around 78.15 while the Euro dipped to lows below 95.50 with the yen still restrained to some extent by fears that the Finance Ministry could push towards additional intervention.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Sterling

Sterling was blocked close to the 1.57 level against the US dollar on Friday with steady losses during the European session as the US currency secured wider gains. The wider Euro impact was illustrated by the Euro move to fresh 44-month highs near 0.7950 before a slight correction.

The latest UK government borrowing data recorded a June borrowing requirement excluding financial interventions of GBP14.4bn from GBP13.9bn the previous year. There will be further concerns that domestic and international global vulnerability will trigger a further deterioration in the finances and create additional pressure on the government for a policy change.

Defensive considerations remained extremely important with a further inflow of funds from the Euro area s fears over the Euro-zone outlook continued to increase. There will still be underlying fears over the threat of medium-term Sterling vulnerability given the UK fundamental outlook.

Swiss franc

The dollar found support close to 0.98 against the franc on Friday and pushed sharply higher to an 18-month above 0.99 in Asian trading on Monday. The franc remained hostage to the wider Euro moves as the single currency was subjected to renewed selling pressure and the National Bank continued to intervene to protect the 1.20 Euro minimum level.

Further losses for the Euro against other major currencies would increase pressure on the National Bank as intervention levels may be forced higher and there will also be increased pressure for the Euro minimum level to be dropped.

Australian dollar

The Australian dollar hit selling pressure above 1.0420 against the US currency on Friday and moved weaker during the European session as confidence in the Euro and the global growth outlook deteriorated.

There was still some speculation that the Australian currency would gain support from a diversification of central bank reserves into the Australian currency and there was also some carry-trade interest, but it was unable to offset wider negative sentiment. The mood of risk aversion continued in Asia on Monday as regional equity markets were subjected to renewed selling and there was a retreat to lows near 1.03 against the US currency.