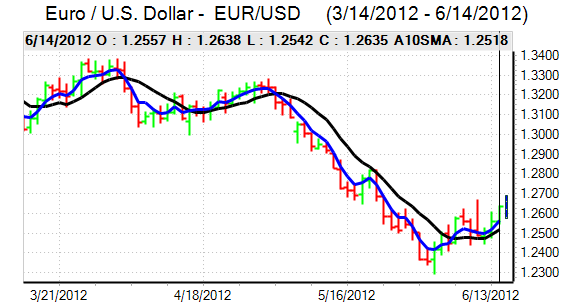

EUR/USD

The Euro was able to find support below 1.2550 against the dollar in Europe on Thursday and nudged higher for the third successive day, although ranges were generally narrow with conflicting fundamentals adding to an already high level of uncertainty.

Following the Moody’s downgrade there was another rise in Spanish bond yields as benchmark 10-year yields briefly rose to the 7.0% level. This is an important level for sentiment with fears that a rise above this level will push Spain towards a wider sovereign bailout. There were reports that the government held emergency talks about the economic situation. Italian yields also rose during the day with three-year yields rising to 5.30% at the latest auction from 3.90% previously.

The Greek elections also remained an important focus and there was some speculation that private opinion polls were suggesting a victory for the New Democracy party. This eased fears over a victory for Syriza with some optimism that the government would maintain a commitment to austerity policies which would lessen the immediate threat of a Euro-zone exit. Although confidence remained very fragile, there was a further incentive to pare speculative short Euro positions.

US jobless claims were slightly higher than expected at 386,000 in the latest week from a revised 380,000 previously which suggested little underlying improvement in the labour market. There was also a 0.3% decline in headline consumer prices for May, although there was a core 0.2% increase in prices. There will be further uncertainty over Federal Reserve policies ahead of next week’s FOMC policy meeting with soft data maintaining speculation over further Fed measures.

As short covering remained an important influence, the Euro pushed to a high above the 1.26 level against the US currency with a high near 1.2650 as there were reports that G20 would hold emergency meetings following the Greek elections and stand ready to provide additional market liquidity. Volatility will inevitably be extremely high at the start of next week.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was again undermined by weaker than expected US economic data on Thursday and dipped to lows close to 79.15 following the releases. There was little evidence of follow-through US selling ahead of the Bank of Japan’s policy meeting. Although risk appetite strengthened during the Asian session, the yen was able to maintain defensive demand which suggested that underlying caution prevailed.

The central bank held interest rates steady at the latest policy meeting and also left the amount of quantitative easing unchanged. Although the decision had been expected, there was a further yen advance to the 78.80 region following the decision and the Japanese currency was able to regain some ground against the Euro.

Sterling

Sterling found support on dips to the 1.5470 area against the dollar on Thursday and rallied to a peak near 1.5550. The UK currency edged weaker against the Euro as it was unable to sustain a recovery through the 0.81 level.

There was further evidence of weaker mortgage lending following the end of tax relief in the first quarter. The overall impact was limited as attention focussed on the Mansion House speech. Bank of England Governor King stated that the case for further quantitative easing was continuing to strengthen and also warned over the threat posed by the Euro-zone crisis. The government and central bank also announced additional measures to provide cheap funds to commercial banks on the basis that this must be channelled into business lending. The bank will also implement its new liquidity programme with details set to be announced on Friday and the total funds available will be GBP80bn.

Defensive considerations will remain very important and there could be further safe-haven flows into Sterling if Euro-zone tensions intensify following the weekend Greek vote.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

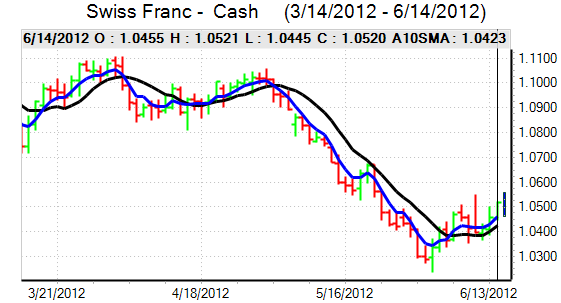

Swiss franc

The National Bank left interest rates unchanged following the latest policy meeting and also maintained the minimum 1.20 Euro level.

The central bank rhetoric was broadly in line with recent comments with a pledge of unlimited intervention to maintain the minimum level. There was also a warning that the bank would consider all policy options in order to prevent franc gains with some hints that capital controls could be considered, although the bank was deliberately vague in its intentions. There was also some warning over the capital level of key commercial Swiss banks which may dampen sentiment.

The Euro was unable to sustain small gains seen ahead of the meeting and the dollar also edged back towards the 0.95 region.

Australian dollar

The Australian dollar found support in the 0.9920 region against the US currency on Thursday and pushed back to re-challenge the parity region late in the European session.

The currency drew support from a weaker US unit and modest gains on Wall Street with reports that central banks were prepared to provide additional liquidity if necessary next week providing the impetus for an Australian dollar move to above the parity level. The currency will gain further support if it appears likely that a pro-austerity government can be elected in Greece, although volatility will inevitably be very high.