One of the most consistently performing sub-sectors of the S&P 500 is showing signs of exhaustion. The Consumer Discretionary Select Sector SPDR Fund (symbol XLY) tracks the sector index of the same name, with holdings including major retail corporations

such as Amazon, Comcast, Home Depot, McDonald’s, and NIKE. See the chart below, and be sure to check out our end-of-year special subscription discount mentioned at the bottom of this post.

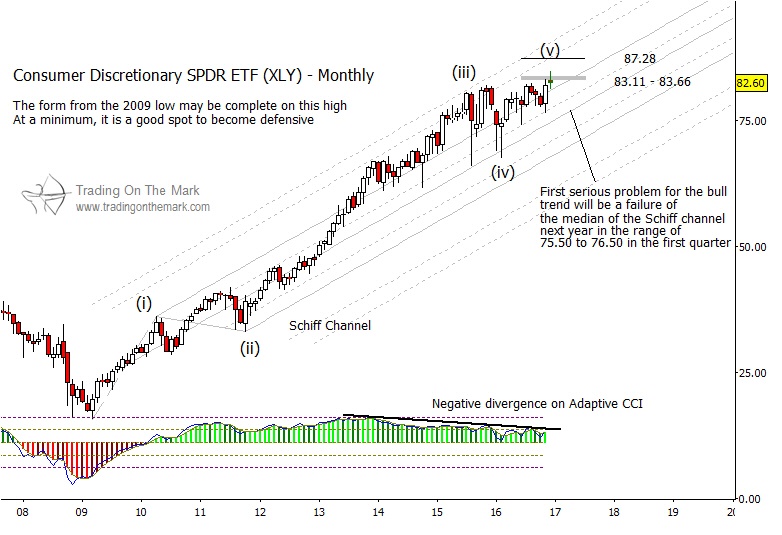

If the long climb from 2009 has represented a five-wave structure, as we believe, then price is now in an area where the fifth wave can be viewed as nearly complete. Based on various Fibonacci measurements among the larger swings, the first main resistance area is nearby at 83.11 to 83.66. A blowoff rally might take price to the next resistance area near 87.28, but that is not required.

The way XLY has behaved with respect to the rising Schiff channel is strongly supportive of the whole rise from 2009 being an impulsive five-wave move. In addition, the way price found support near the center line of the channel in 2015 and early 2016 is classic Elliott wave behavior for a fourth wave. That’s why we are watching for resistance near Fibonacci multiples of the height of wave (i), as projected upward from the bottom of wave (iv).

The growing divergence between price and the Adaptive CCI momentum indicator also signals weakening.

Going forward, it appears to be very late in the game to take new long positions, but trying to catch the top of such a large move is risky and difficult. A bearish view would gain more credence if price falls beneath the center line of the Schiff channel, which would mean testing and breaking through the area near 75.50 to 76.50 sometime in 2017.

There are just a few days left for you to claim our special subscription discount for new subscribers! This month, we’re offering a 20% discount for all new subscriptions taken for our daily analysis service, which includes regular updates for the S&P 500, crude oil, the Dollar and other currencies, precious metals, bonds, and more. If you sign up for a longer subscription period – 3 months or 6 months – the discount makes your savings even greater. Just follow this link and use the coupon code 4CCF7 to claim your discount.