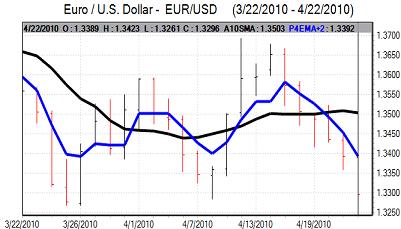

EUR/USD

The Euro edged back to 1.32 on Wednesday with speculation over increased IMF support helping trigger a corrective Euro bounce following the recent sharp losses.

The European debt situation remained an important focus during the day. There were expectations that the IMF would provide additional funds to the Greek support package with the amount likely to be boosted to EUR100-120bn in an attempt to stabilise market confidence. The EU also announced that an economic summit would be held on May 10th to discuss the situation while there was strong pressure on the German government to ratify any agreement.

There was a narrowing of Greek yield spreads from record levels above 1000 basis points and the Euro recovered to the 1.3260 area before weakening again. The Euro came under renewed selling pressure later in the European session as Standard & poor’s downgraded the Spanish credit rating. The downgrade reinforced market fears that contagion could become a very important market factor. In response, the Euro weakened to fresh 2010 lows near 1.3110 before stabilising.

The Federal Reserve held interest rates in the 0.00-0.25% range following the latest FOMC meeting. The statement was more optimistic on the economy with comments that activity has continued to strengthen while the labour-market was beginning to improve. The Fed did, however, also maintain its commitment to keeping interest rates at exceptionally low levels for an expended period. In a repeat of the previous two meetings, Regional Fed Governor Hoenig dissented and called for the extended period reference to be dropped.

The statement again disappointed expectations that there could be a change in rhetoric and the dollar weakened back to the 1.32 area in US trading.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

After deteriorating sharply in New York, there was some degree of stabilisation in Asian trading on Wednesday as bargain hunters looked to buy higher-risk assets. The Japanese currency was still broadly resilient with the dollar unable to move back above the 93.30 area. Risk appetite remains generally weaker with unease over European sovereign debt ratings continuing to unsettle markets.

There was a weaker tone for the yen in European and US trading with the US currency strengthening to highs around 94.30 and the Japanese currency also lost ground on the crosses. The dollar held the bulk of the gains following the Fed statement even though there was no further improvement in yield support.

Sterling

Sterling maintained a generally weaker tone in early Europe on Wednesday as confidence in the fundamental outlook remained fragile.

The UK sovereign credit rating will remain an important market focus in the short term. There will certainly be further speculation that the AAA rating will be lost in the medium term. The ratings agencies, however, are likely to wait for early developments in the next parliament and will also be very reluctant to make any change during the election campaign.

In this context, the rating should be secure for now, but any move to downgrade would have a substantial negative impact on Sterling sentiment and confidence is liable to remain very fragile, especially after the Spanish downgrade.

Sterling weakened to lows around 1.5125 against the US dollar before recovering back towards the 1.52 level while the UK currency was little changed against the Euro.

Swiss franc

The dollar dipped to lows near 1.0815 against the Swiss franc in European trading before rallying strongly to a high of 1.0920 as European currencies were subjected to renewed downward pressure. This was the strongest dollar level since July 2009 while the Euro was unable to make any headway.

Sovereign credit ratings will remain an important focus in the short term and there is still the potential for some franc support on fears over the Euro-zone outlook. The potential for franc gains is likely to remain stronger if there is a sustained deterioration in risk appetite.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

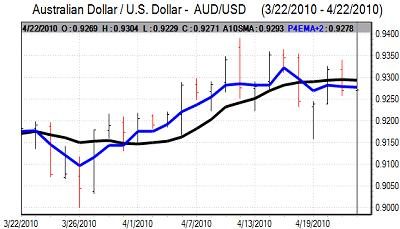

Australian dollar

The headline Australian inflation data was in line with expectations, but a higher than expected underlying figure provided some degree of support for the currency on expectations that interest rates could be increased further.

The Australian dollar dipped to lows near 0.9135 against the US dollar before rallying back to the 0.9255 area. Underlying confidence remained fragile, but the currency did prove to be broadly resilient with buying support on significant retreats.