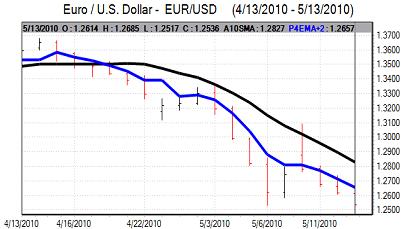

EUR/USD

The Euro was unable to regain the 1.27 level against the US dollar on Thursday and drifted weaker as underlying sentiment remained weak.

There was an announcement of budget cuts by the Portuguese government following the fiscal package announced by the Spanish administration the previous day. The government is aiming to cut the deficit to 4.6% of GDP for 2011 from around 8% of GDP this year. The cuts should help underpin confidence that Euro-zone governments will make attempts to control spending.

There will, however, also be fears that the very restrictive fiscal policies will have a negative impact on demand in the Euro-zone and maintain pressure for low interest rates. The Euro is also still being unsettled by fears that there will still need to be debt restructuring in the medium term. Underlying Euro sentiment remained weak with no sustained relief.

The US economic data had very little impact with initial jobless claims in line with market expectations at 444,000 in the latest reporting week from a revised 448,000 previously. There was also a 0.9% increase in import prices for the latest month and markets continued to expect euro-zone out-performance.

The Euro weakened back to near 14-month lows just above 1.2510 before stabilising. There was some speculation that prominent hedge funds were covering short positions and this provided some Euro protection close to the 1.25 level.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

There were only limited fresh incentives in Asia on Thursday as risk appetite looked to stabilise. A firm Australia employment report also had a positive impact in boosting interest in carry trades. The latest Japanese consumer confidence data showed a monthly increase which will provide some degree of relief over potential spending trends.

The capital account data showed that Japanese institutions sold JPY1.57trn in bonds last week and this does suggest an increase in structural fears and any further capital repatriation would underpin the yen. The dollar held steady on Thursday, but was unable to make significant progress with further resistance on moves towards the 93.50 area.

The dollar was unable to make further headway during the day and weakened to 92.75 in US trading as investors took a more cautious attitude towards sovereign debt, especially as Wall Street weakened.

Sterling

Sterling was blocked just above 1.49 in early Europe on Thursday and weakened steadily during the day. The UK trade deficit was weaker than expected with a goods deficit of GBP7.5bn for March from a revised GBP6.3bn the previous month as imports rose strongly which had some negative impact on sentiment.

The government announced a preliminary stance towards the budget over the next year and there were suggestions that policy will be tightened more quickly than expected. There will be unease that the economy could dip back into recession which undermined Sterling confidence.

The UK currency was also undermined by wider sovereign debt fears and a lack of confidence in European currencies. In this environment, Sterling weakened to lows just below 1.46 against the dollar as selling intensified following a break of technical support in the 1.47 area. The Euro strengthened to around 0.8580 against Sterling.

Swiss franc

The dollar found support close to 1.1075 against the franc on Thursday and strengthened to a high just above 1.1160 in US trading. The Euro was trapped close to 1.40 against the Swiss currency and there will be a suspicion that the National Bank was intervening to prevent further losses.

With firm readings for business and consumer confidence there will be further expectations that the bank will decide against blocking franc gains and that the Swiss currency will be allowed to strengthen further against the Euro.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

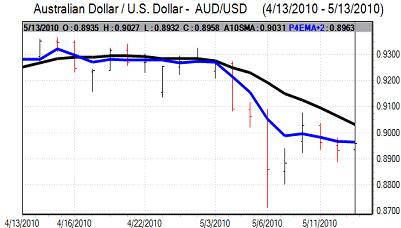

Australian dollar

The Australian dollar found further support close to the 0.89 level against the US dollar during Wednesday and pushed to the 0.90 level in local trading on Thursday. The employment data was stronger than expected with a further 33,700 increase in employment for April. There was also some stabilisation in risk appetite which helped underpin the local currency.

The Australian dollar was unable to extend gains and retreated back towards the 0.8940 area during US trading as underlying risk appetite was still more cautious, especially after equity prices weakened.