EUR/USD

Narrow ranges dominated in early Asia on Friday as the Euro resisted selling pressure, but also found it difficult to gain any further momentum. Technical considerations remained an important influence during the day as the Euro approached longer-term downtrend resistance levels.

ECB officials were still generally cautious over economic prospects in comments on Friday with warnings over a second-half slowdown in growth which tended to sap Euro support to some extent. There was also a further rise in Euro Libor rates which reinforced unease over underlying stresses within the money markets. In this environment, Euro confidence could still deteriorate rapidly within the next few weeks.

The latest speculative positioning data recorded a further net decline in Euro short positions which will lessen the potential for further near-term positions adjustment. There was also speculation that the Euro was being used as a funding currency while the data on risk reversals suggested that there was still underlying selling pressure on the Euro on structural vulnerabilities.

There were no significant US data releases during the day, but the latest ECRI leading indicators data recorded a further downturn which will reinforce unease over US economic trends. The Euro was unable to sustain a move above 1.27 against the dollar and weakened back towards 1.26 before consolidating above 1.2620.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The US Treasury released its delayed currency report late on Thursday and there was no move to accuse China of currency manipulation. This decision was not a surprise, especially after China announced a more flexible yuan policy in June, but there was still some relief which helped underpin Asian equity markets on Friday and curbed defensive yen demand.

With risk appetite holding steady, the dollar was able to edge stronger against the yen with a move back to challenge resistance levels above 88.60 while the Euro held above 112.20 with major pairs holding in narrow ranges.

There were no major fresh influences during the US trading session and the dollar was able to edge above the 88.60 level as there was an improvement in yield support.

Sterling

Sterling again hit selling pressure above 1.52 against the US dollar in early Europe on Friday as technical resistance remained strong.

The latest UK producer-prices data recorded a lower than expected 0.2% decline in producer input prices for June while output prices also declined and this may dampen inflation concerns to some extent. The consumer inflation data will be watched closely next week for further evidence on the underlying inflation trends.

The trade data was worse than expected with a goods deficit of GBP8.1bn for May after a revised GBP7.4bn shortfall the previous month. There was a disappointing performance for exports which will maintain fears over longer-term trends and this will have some negative impact on Sterling sentiment. The IMF was also uneasy over the aggressive fiscal tightening with fears that the economy would slide back into recession.

Sterling weakened to lows near 1.5060 against the dollar during the US session on a series of mildly negative factors while the UK currency also dipped to five-week lows close to 0.84 against the Euro.

Swiss franc

The dollar found support below 1.05 against the franc on Friday and it recovered to highs near 1.06 before running into fresh selling pressure. The Euro edged higher towards 1.3350 against the Swiss currency as selling pressure abated.

Risk appetite remained firmer during the day and this may curb franc buying to some extent, although there is still likely to be underlying demand for the currency given underlying vulnerabilities.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

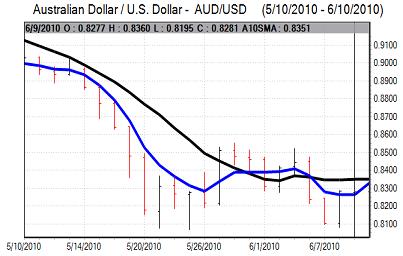

Australian dollar

The Australian dollar found further support above 0.87 against the US currency during Friday and maintained a generally firmer tone during the day. Risk appetite remained generally firmer during the day which helped underpin the currency. There was some evidence of fresh interest in carry trades which also boosted the Australian dollar.

Freight rates fell again on Friday to give the longest series of declines for over five years and there are still important risks to the global economy which will tend to limit buying support for the currency.