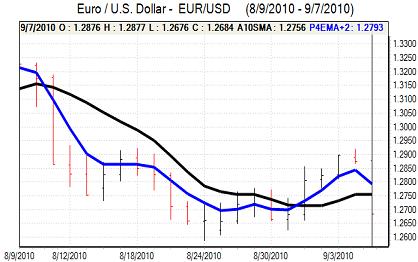

EUR/USD

The Euro remained under pressure in European trading on Tuesday and retreated to test support levels below 1.2750 against the dollar. A weaker than expected German industrial orders report increased speculation that the recent rebound in growth could stall.

There were further concerns over the Euro-zone banking sector which continued to unsettle the currency. There was also a continued widening of yield spreads within the area as yields in countries such as Portugal and Spain rose. The increase in bond yields will make it even more difficult for the weaker countries to finance budget deficits and will increase the cost of fiscal tightening. In this environment, the risks of a vicious cycle remains an extremely important source of longer-term vulnerability for the economies and the Euro.

There were no major US economic releases during the session with underlying confidence in the economy remaining weak. Although 2 regional Fed banks requested a discount rate increase this month, the main centre of attention was still on the possibility of further quantitative easing by the Federal Reserve which will curb dollar yield support.

With the dollar unable to secure firm support, the Euro losses were focussed more on the crosses. The Euro still weakened to test support levels below 1.27 in Asian trading on Wednesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to secure any gains against the yen on Tuesday and gradually drifted lower with a test of support below 84. As buying interest remained weak, the currency remained under pressure and hit fresh 15-year lows just below 83.50.

Finance Minister Noda stated that he was ready to act and that decisive steps would be taken including intervention. Noda also stated that it would be difficult to gain international support for intervention and markets continue to suspect that the yen will need to strengthen much further before the necessary political will can be found.

The Japanese current account surplus was higher than expected which increased confidence that the economy could withstand a strong yen and the latest machinery orders data was also stronger than expected which provided underlying yen support.

Sterling

Sterling remained on the defensive against the dollar during Tuesday and tested support levels close to 1.53 before finding support and moving back above 1.5350. The UK currency regained ground against the Euro, strengthening to near 0.8270.

Sterling has gained support within Europe from renewed fears over the European banking sector and sovereign-debt default risks. In relative terms, this support could continue in the very short term, but Sterling will be much more vulnerable to general selling pressure if confidence in the UK banking sector weakens again.

There were no major UK data releases during the session with the BRC shop-price index at 1.7% in the year to August as food-price inflation accelerated. Sterling held firm against the dollar in Asia on Tuesday as the dollar and Euro were also struggling for support.

Swiss franc

The Swiss franc continued to gain important defensive support on Tuesday with a strong advance against the Euro as Euro-zone banking fears increased. The Euro retreated to fresh all-time lows below 1.2850 and was unable to gain any respite in Asian trading on Wednesday.

The dollar was also unable to regain the 1.02 level and retreated to lows below 1.01 against the franc. The Swiss currency is still being seen as a very important safe-haven currency, especially with confidence in the dollar and Euro both tarnished.

Markets will still need to be on high alert for National Bank action to deter rapid franc gains.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

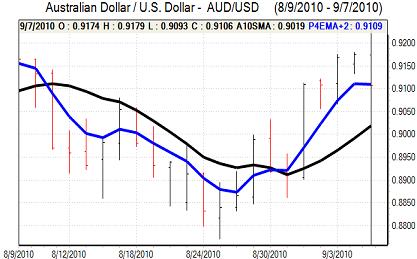

Australian dollar

The Australian dollar remained weaker in European trading on Tuesday, undermined by the general deterioration in risk appetite, but it did find support below the 0.91 level against the US currency and was able to move higher later in the US session

The domestic economic data was slightly stronger than expected and there was relief that a new government had been formed. The latest employment data, due for release on Thursday, will be important for sentiment

There was still little scope for gains in the local currency given that international risk appetite remained weaker.