Keep it simple. 5 Facts:

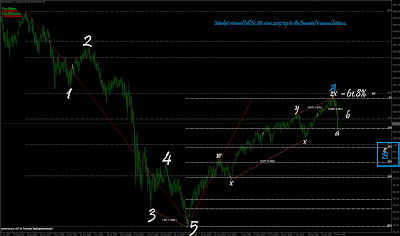

1) Major range 61.8% top reached and hit to reverse.

(It would be far more weird if such a reverse would be not be placed with golden cross).

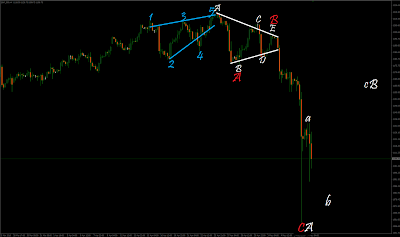

2) Five wave movement was clearly placed.

(which clearly does not fit for normal impulse procedure behaviour with internal structure, even number of “swings” does ie. 5 waves).

3) Think positive, if it would come true it would be bulllish in fact far much later, because next would be C up wave after B correction is placed.

4) Entire up movement since bottom was retraced by 23.6% with yesterday plunge as ultimate bottom with overlap, none of the wave scenario never ends up anything with 23.6%, only first part of corrective wave can do that ie. most often A wave. This suggest we have still a lot of bear movements to come to and we potentially placed A wave. The white c/B as upwave marked to the chart are not likely going to achieve any high retracement numbers like 78.6%, might be even difficult to reach any 61.8% anymore to place corrective B upwave, we might be happy if we can even reach 50 % but with theory rules it should also reached 50% as minium for B wave.

5) Contracting triangle marked by white in the top is NeoWave theory triangle, it seems to apply same internal structure rules as original R.N Elliott triangle, but it´s position differs slightly (meaning it is not only W2, W4 and B + X waves as only choice where it can be, the difference is just more cosmetic because R.N Elliott Wave would mark it as W1, then “abc” correction to mark W2 for last c).