Last week

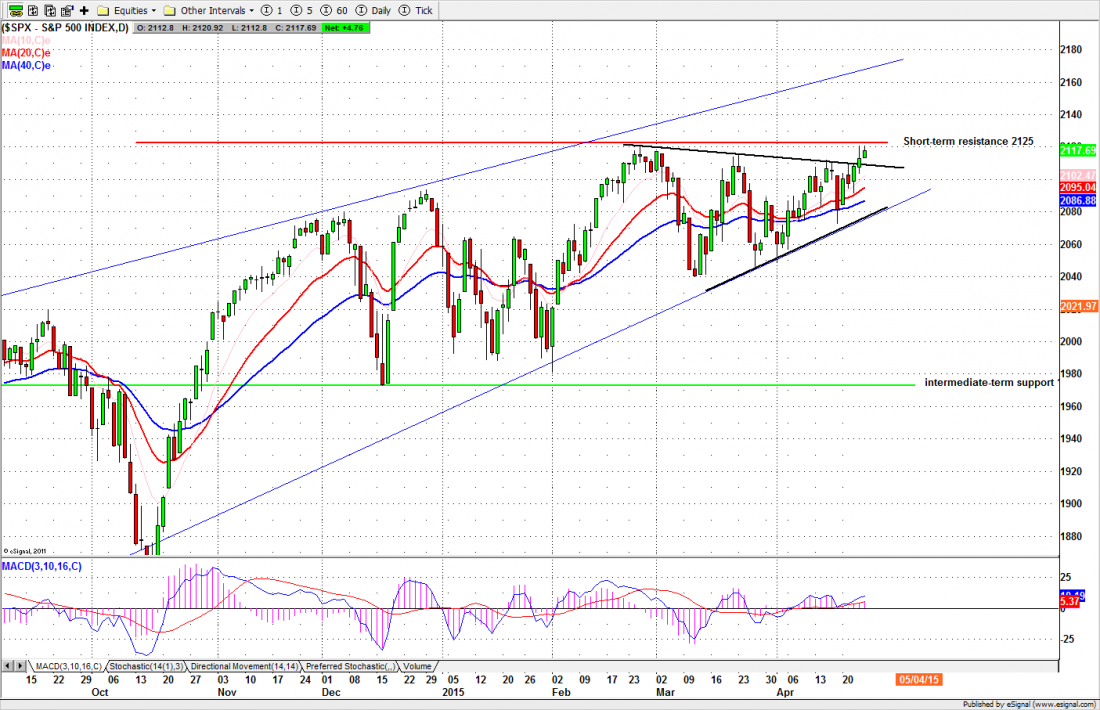

Last week the S&P 500, the large-cap equities index, rose 1.75%, a decent rally for the week, and made a new all-time high for the close. It ended the week at 2117.69, just a few pennies above the high close set on March 2. The gain for the week was about 36 points.

It is encouraging to see a new high – the SPX also made an new intraday high at 2120.92 on Friday – and the Bulls will feast on the idea that the market closed near the high for the week and above the high of the previous week. Buy! Buy!

But don’t knock the top off the bubbly just yet. The SPX is still trading below the near-term resistance area, and is still within a congestion range that has been containing the price for several weeks.

At the beginning of May we are finally back to where we were at the beginning of March, and barely 30 points above the high made the last week in December. Even the eternal optimists urging everybody else to pile into the market are having a little trouble with that.

We are waiting for a definitive break-out from the near-term resistance that has held prices down since the last week of February, and we need to see some signs of it soon. This is the best time of the year for equities but this favorable season is coming to an end.

We are expecting change-in-trend periods around May 11 and May 25. After that its “sell in May and go away.” We are are unlikely to see a roaring bull in the summer doldrums.

The next upside target in around 2168; if we’re going to get there, we have to get started.

Note that this doesn’t make our outlook bearish. The long-term support is around 1980 and we’re a long way above it. The intermediate-term support is 2055-45 and if we don’t breach that level then any retracement will be small and short.

We’re still long-term Bulls. But we’re becoming impatient Bulls.

This week

There’s a lot going on this week (week of Apr. 27) and a lot of it is likely to generate some pretty good swings in the SPX.

APPL releases its Q1 earnings after the market closes on Monday, and there is every indication it will beat expectations easily. (No surprise. Earning expectations are routinely manipulated precisely so they can be beaten, good times or bad).

APPL alone is responsible for about half of the S&P500 earnings increase in Q4 2014, and will have a similar impact on Q1 2015. The market will be frothy in anticipation of good numbers, but remember: APPL gets about 70% of its sales and 80% of its profits from a single product, and that product is essentially a fashion accessory for Chinese teenagers.

We get the Q1 GDP report early this week, and it will be less rosy than the APPL numbers. There is also the Fed Open Market Committee meeting Tuesday and Wednesday. The FOMC always generates lots of excitement and price swings, but with little permanent effect. The current rumble is still about the potential for an interest rate hike in June. We think it is possible, but not likely.

The Fed has backed down every time so far, and some commentators are arguing that they won’t hike before 2017. We won’t go that far, but a hike in June would be a surprise to many traders. The market hates surprises, and these past six years, the Fed has hated what the market hates.

For the SPX this week, the important resistance is around 2125. Break that, and the market has a shot at 2160 or higher. The important support is 2185-90. Break that, and we might see a re-test of 2070-75.

ESM5

The S&P500 mini-futures (ES) made an inside day on Friday (Apr. 4) with a relatively narrow range. We usually expect a range expansion will follow that pattern. The ES could take out the resistance at 2115-2117 early and drop back, or make a minor pullback first and a break out later. If it fails to break through the resistance, we’re expecting a repeat of Friday’s Globex range, 2114.75-2103.

The ES has had a pretty good rally over the past week; a little profit-taking would be no surprise. But we are not expecting any change in the short-term uptrend. Last week’s Globex low at 2078.50 should be major support. As long as ES holds above that support the short-term uptrend remains intact.

Major support levels for Monday: 2078.50-75.50, 2062.50-64.50, 2045-50;

major resistance levels: 2115.50-18.00 and none

####

Naturus.com publishes a free weekly analysis of US equity indices. To get on the mailing list please click here.

For more articles like this: