On Sunday evening the S&P 500 mini-futures (ESU4) traded above 1961.00, which means they gained back all the ground they lost on Friday when a now-discredited war report slammed the market down more than 20 points in a couple of hours.

And it made much of that bounce while the market was closed!

On Sunday the futures also busted through the 68% retracement level of the big drop that started at the end of July – the one that was supposed to be the start of the waterfall down, the bursting of the bubble, and maybe the end of the world as we know it.

Didn’t happen. Instead the market swatted the shorts away like so many mosquitoes – noisy, annoying, but not very important.

Remember the old Timex watch ads? “Takes a lickin’, but keeps on tickin’.” That’s what this market feels like.

It is trading in nosebleed territory, and almost every public commentary warns that the bubble must burst, and probably soon. But the Timex Market just keeps on tickin’. And we think it is likely to continue, at least for this week. Here’s why:

• No more war. You can never be certain about this, but it doesn’t look like the various conflicts will expand to the point that they affect the market. ISIS has been slowed down in Iraq, Israel isn’t bombing Gaza at the moment, and the Russians are not likely to invade the Ukraine. In any case the market is getting a little bored with war talk. Unless something serious happens it just doesn’t have the same impact any more.

• A quiet Fed. We’ve got both the Fed FOMC minutes and the VIX options expiring on Wednesday (Aug. 20). That may give us a little hiccup. But the world’s financial heavyweights are meeting at Jackson Hole next weekend. There will be lots of speculation about what they are going to say, but there won’t be any real news from that source before next weekend.

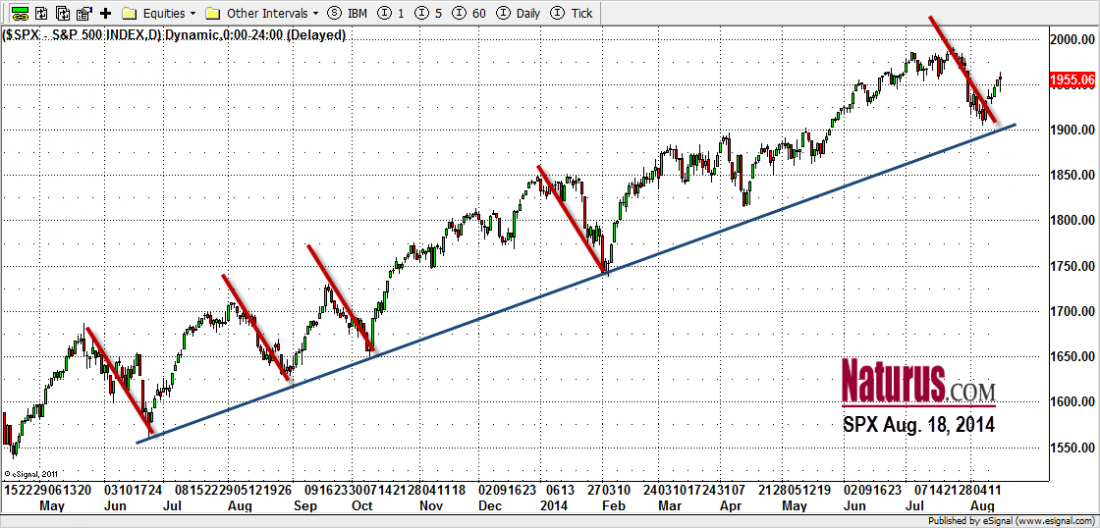

• We’ve done this before. Over the past 13 months the SPX has made four similar moves, each one threatening to break the market, each one leading to a move higher. (See chart). One of these days it will be the real deal. But probably not this time. Besides, it’s the last two weeks of the summer vacation season, when markets snooze – absent any thunderbolts from the real world.

What We Expect To Happen

There is resistance ahead for the futures around 1965, If the price moves through that resistance the next stopping point is 1985, the previous high. Market sentiment is bullish, but we doubt it is bullish enough to move substantially above that level this week.

If the price stalls below 1965, it may pull back down to the support levels around 1940. If it breaks down the support, it may drop to 1920-1900. We don’t see it moving much past there, unless some fool lets slip the dogs of war.

Our best guess: a choppy week with no clear direction, hacking back and forth between 1985 and 1920.

To see a complete analysis of the outlook for next week, including bonds and oil, follow this link. It’s free.

Chart: SPX Daily bars. To Aug. 18, 2014