The cash markets were closed last Friday and futures were open, and the jobs numbers came out well below expectations. That sent the SPX futures down some 19 points, which carried over into the Monday open. The bearish bloggers were talking about how bad the economy is and why we are going to crash.

CNBC had headlines all morning “markets lower because of bad job numbers Friday.” But the low was made within the first five minutes of trading, as we have seen so many times.

Now the bullish bloggers are saying the bad numbers are going to keep the Fed on the sidelines for raising rates, and that will be “the reason” we will see higher levels in the coming months/years. The question that I always ask myself is: “Why does everyone need a reason?”

Try and put the odds on your side by looking at investor sentiment and technical analysis. Forget trying to put a reason on the direction. There are either going to be more buyers than sellers and we move higher, or there will be more sellers than buyers and we head lower. Anticipating the changing from more buyers or sellers is how you make money in the stock market.

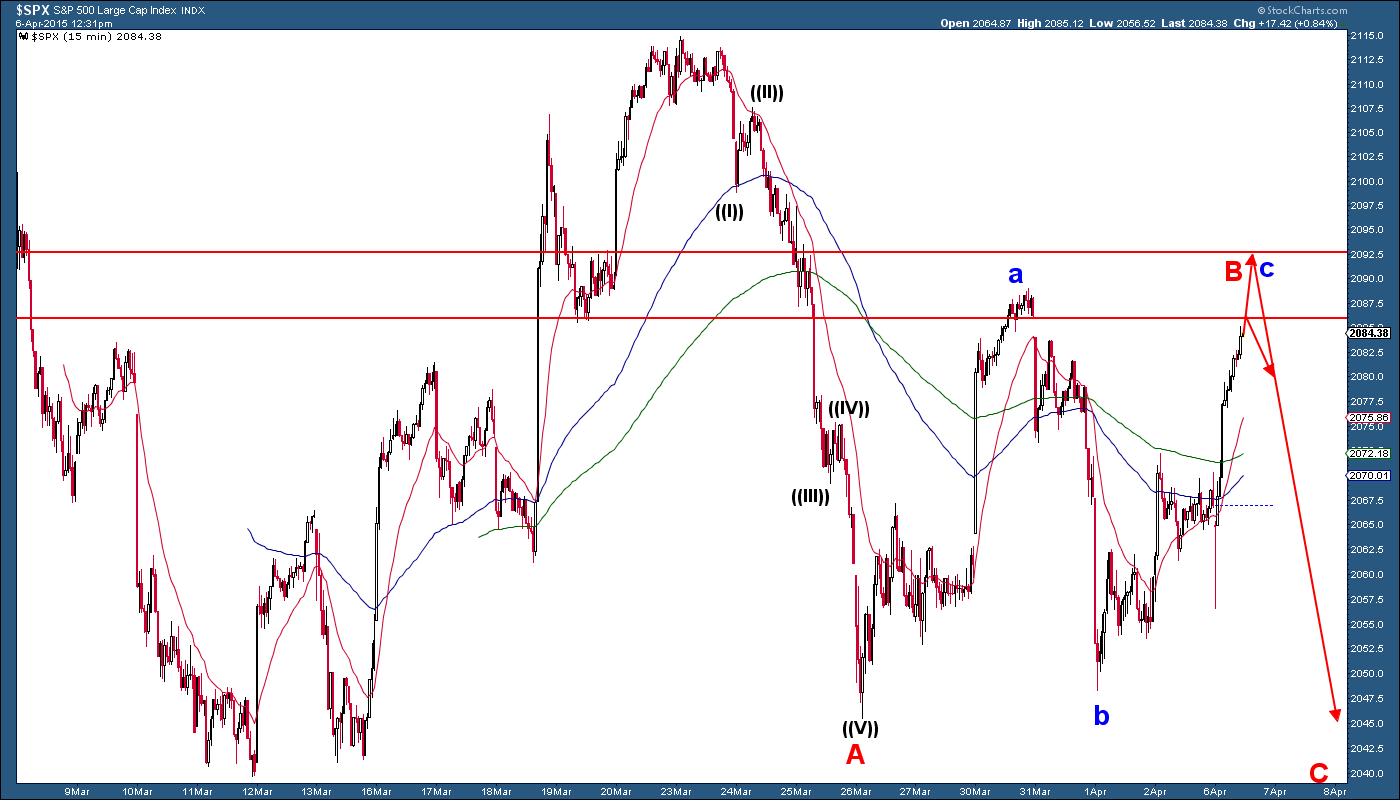

Investor sentiment has been pretty neutral overall. The technical view, however, is favoring another move lower, before higher. The SPX appears to be in some type of wave B up. That should be formed in an ABC pattern, and when that completes, wave C down should kick in.

The chart below shows the best wave structure at this point. Of course nothing is a sure thing, but we are just trying to put the odds of the trade on our side. Anywhere between 2080-2092 makes sense for this wave B higher to complete.

#####

To get your free Sentiment Timing Index Chart, please click here.