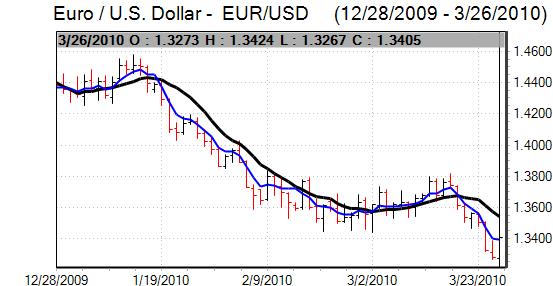

EUR/USD

ECB President Trichet took a more positive tone towards the Greek financial-support package on Friday which helped push the Euro back to the 1.3340 region in early European trading.

There was still a high degree of uncertainty over the Greek situation and there was still considerable caution over the outlook given the medium-term difficulties. Markets remained sceptical that there would be a durable solution and there was still unease that debt and rating problems would spread to other countries such as Spain.

The final fourth-quarter GDP estimate was revised down to an annualised rate of 5.6% from 5.9%. The University of Michigan consumer confidence index was revised to 73.6 from the original 72.5 original estimate which was unchanged from the previous month and did not have a substantial impact. The US currency should still gain some degree of support from the rise in yields seen over the past week. Fed Governor Warsh also stated that he was feeling more optimistic towards the US economy which helped underpin sentiment to some extent.

Position adjustment was important on Friday with the Euro gaining some fresh degree of support after heavy losses during the week. In this context, the currency pushed to a high around 1.3420 against the dollar.

There will be some degree of caution next week ahead of the US employment report. There will be expectations of a significant employment gain for the month which should provide some degree of underlying dollar support early next week.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Domestically, core consumer prices declined by 1.2% in the year to February which was marginally lower than expected, but there will still be persistent unease over the deflation threat within Japan and pressure on the Bank of Japan to maintain a highly-expansionary policy will continue which will tend to unsettle the yen.

The US currency edged back towards 92.50 in early Europe on Friday as there was reduced demand for both the yen and dollar due to a general improvement in risk appetite.

The dollar was marginally weaker in US trading while the Japanese currency lost ground against the Euro during the day.

Sterling

A dollar correction weaker initially allowed a Sterling recovery back towards 1.4870 in early Europe on Friday, but it then weakened again after a critical report on the recent budget from the Institute for Fiscal Studies.

There was still a lack of confidence in the underlying debt situation with fears that there would need to be a substantial cut in spending following the general election which would also tend to weaken the economy.

The revised fourth-quarter investment estimates recorded a decline of 4.3% which was slightly better than the original estimate, although there was still a record decline for the quarter as capital spending levels remained weak.

The UK currency again secured support close to the 1.48 level against the dollar and there was a recovery to the 1.4920 area later in the US session. The Euro consolidated close to 0.90 against Sterling.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

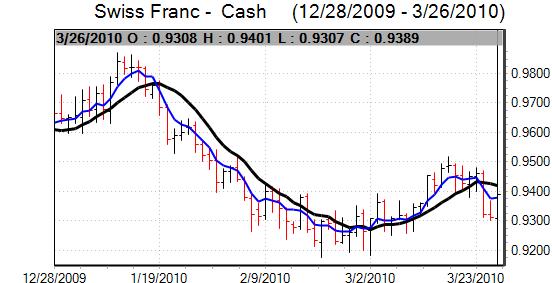

Swiss franc

The dollar was again blocked close to 1.0750 against the franc during Friday and weakened to lows below 1.0650 during the US session. After a period of strong downward pressure, the Euro attempted to secure a corrective recovery, but it was unable to sustain a move above the 1.43 level.

The KOF economic institute revised higher the GDP growth forecasts for 2010 and 2011 which maintained an underlying mood of optimism towards the Swiss economy and this should provide some degree of support for the franc.

Although immediate tensions have eased, an underlying lack of confidence in the Euro-zone will continue to provide some degree of support for the Swiss currency.

Australian dollar

The Australian dollar was blocked in the 0.91 level against the US dollar on Friday and had a steadily weaker tone during the day with a low close to the 0.90 level before a partial recovery.

Significantly, the Australian currency lost support even though the US currency was generally weaker and this suggests that there may have been a paring of long speculative positions after a failure to break resistance.