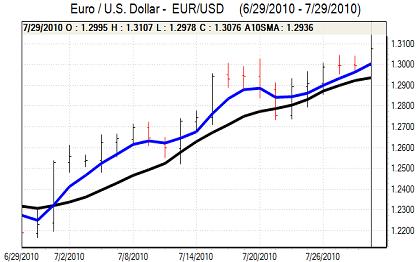

EUR/USD

The Euro found support close to 1.30 in early Europe on Thursday and challenged resistance levels during the day as funds attempted to extend the recent rally.

The Euro-zone data was again stronger than expected with gains for business confidence while there was a further decline in German unemployment which helped underpin sentiment towards the economy. In this environment, the Euro was able to push to challenge 12-week highs just above 1.31 against the dollar.

The US data was close to expectations with a decline in jobless claims to 457,000 in the latest week from a revised 468,000 the previous week and this did not have a major market impact. There were still fears over an underlying deterioration in the US economy which curbed underlying dollar support.

There were further rumours of central bank action in the Euro/dollar market during the day. There was some buying support, but the main focus was on speculation over reserve diversification away from the Euro. With evidence of institutional selling as well, the Euro was unable to extend gains.

The dollar was unable to take much advantage from Euro profit taking and the consolidated just below 1.31 later in the US session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Investors were still cautious over the global economic outlook for much of Tuesday. Equity markets were slightly weaker which provided some defensive yen support, although market moves were relatively limited with a lack of major fresh incentives during the session.

Domestically, the retail sales data was slightly stronger than expected with a 3.2% increase in the year to June. Markets were still sensitive to the deflation threat and pressure for yen gains to be resisted. The yen edged stronger against the dollar with the US currency finding some support close to the 87.00 level.

The US currency was subjected to further selling pressure in New York trading and there was a low close to 86.55 before a tentative recovery as Wall Street also erased initial losses.

Sterling

Sterling resisted selling pressure on Thursday even as the Nationwide reported a 0.5% decline in house prices for July, the first decline of the year.

The mortgage lending data was also weaker than expected with a drop in approvals to the lowest level since February. The consumer lending data disappointed as well with a monthly decline in consumer credit. With incomes under pressure and weak credit growth, there will be surprise over the recent strength of consumer spending data.

There will also be expectations of a slowdown in the housing sector and doubts over the economy are liable to increase. This could eventually sap support for Sterling, especially as there will be further doubts over the prospect for higher interest rates given the fiscal tightening.

Sterling hit resistance close to 1.5650 against the dollar and failed support below 1.56 against the US currency in the US session. Sterling retreated to lows towards 0.8380 against the Euro.

Swiss franc

The Swiss currency advanced strongly against the Euro during the day with the Euro weakening to a low near 1.3580 from 1.3750 early in the European session. With the dollar also generally on the defensive, the US currency weakened to a low around 1.0375 against the franc.

There were strong rumours that the Swiss National Bank was looking to diversify its foreign-exchange reserves during the day with reports of Euro selling which contributed to the sharp franc gains on the crosses as it also secured strong gains against Sterling.

Underlying franc confidence is likely to remain robust given that the currency advanced in conditions of generally firm risk appetite.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

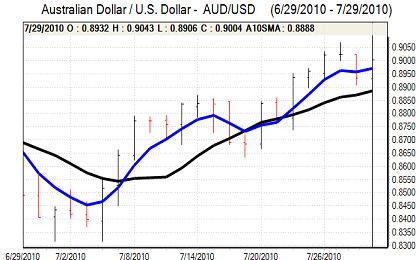

Australian dollar

There was an Australian dollar recovery in local trading on Thursday with gains to near the 0.90 level and there were further gains in Europe with a peak close to 0.9050 as the US dollar also came under selling pressure.

There will still be reduced expectations of higher Reserve Bank interest rates which will curb Australian currency buying support. Overall confidence in carry trades and high-yield instruments is also likely to be cautious given persistent doubts over the durability of the rebound. On a near-term view, the Australian currency was able to hold close to the 0.90 level as underlying buying support persisted.