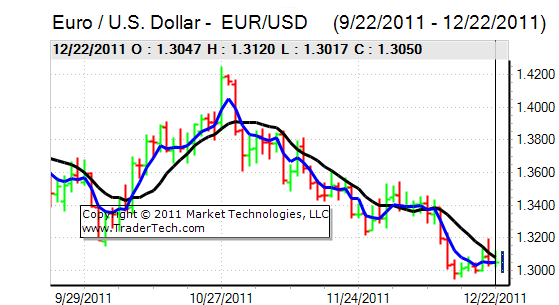

EUR/USD

The Euro found support in the 1.3020 area against the dollar in Europe on Thursday and, in a similar pattern to the previous day, there were gains around the US open as it pushed to highs above 1.3110. There was a retreat back to the 1.3020 area later in the US session as rallies quickly attracted selling pressure.

Trading volumes declined during the day and conditions will inevitably be extremely subdued on Friday with very low trading volumes set to continue into next week.

There was further relief that major stresses which could have provoked a major European banking crisis had at least been eased by recent ECB actions. There were still important signs of tensions as dollar Libor rates continued to increase. There are still major uncertainties surrounding Greece and there were also growing expectations that the Euro would tend to weaken even if the Euro was salvaged in its current form with the ECB pushed further towards the route of quantitative easing to stave-off potential deflation and a deep recession.

The US data was generally stronger than expected with a further decline in jobless claims to 364,000 in the latest week from 368,000 previously, maintaining a consistently stronger trend during the past few weeks. There was a further downward revision to the third-quarter GDP data to 1.8% from 2.0%, but markets were focussed more on the economic prospects and there was a further improvement in the University of Michigan consumer confidence data to 69.9 for December from a preliminary 67.7.

The data maintained expectations of US out-performance in the near term at least which provided some underlying dollar support and also curbed Euro support even though risk appetite improved.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support below 78 against the yen on Thursday and was able to make a more determined attack on resistance levels, but it was unable to break above the 78.20 area. The dollar did secure some support from generally robust economic US data with a generally solid tone for risk appetite also tending to curb defensive yen support.

The slightly more optimistic near-term tone surrounding risk appetite continued to clash with unease surrounding 2012 prospects with a high degree of caution surrounding Europe and China. In this context, there was still a reluctance to sell the yen aggressively with underlying capital outflows still limited and overall trading ranges remained narrow.

Sterling

Sterling hit resistance above 1.5720 against the dollar on Thursday and dipped back to the 1.5650 area before a fresh move higher as wider US currency moves tended to dominate. The UK currency maintained a strong tone against the Euro as it held stronger than the 0.8350 level.

There was still some evidence of underlying capital flows into the UK. Market conditions will, however, be very thin over the remainder of 2011 and this will increase the risk of erratic trading conditions.

There was a small upward revision to 0.6% from 0.5% for the UK third-quarter GDP data which provided some slight support to Sterling. In contrast, the latest current account data was much weaker than expected with the third-quarter deficit estimated at a record high of GBP15.2bn from a revised GBP7.4bn previously. The data is extremely erratic on a quarterly basis, but will have some damaging impact on medium-term sentiment.

Swiss franc

The dollar found support on dips towards 0.9310 against the franc on Thursday and rallied to a peak of near 0.94 before consolidating in the middle of this range. The Swiss currency maintained a weaker tone against the Euro, although it did recover from lows near 1.2250.

With trading volumes continuing to decline, the National Bank will find it much easier to prevent any renewed franc appreciation and will also find it easier to push the currency weaker through verbal intervention. In this context, underlying franc demand is liable to be weaker, although choppy trading remains an important short-term risk.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

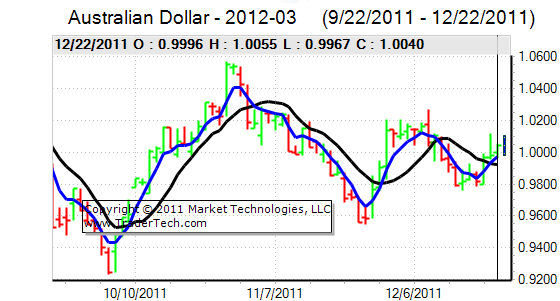

Australian dollar

The Australian dollar found support below 1.0080 against the US currency on Thursday and pushed higher during the day with a peak near 1.0180 in Asia on Friday as the Australian currency also challenged record highs against the Euro.

Markets wanted to take a more positive attitude on risk following generally firm US economic data which helped underpin the currency amid potentially positive year-end flows. The domestic influences remained very limited, although the absence of major volatility may have triggered some interest in carry trades.