Here’s what we know right now.

Major indices remain under distribution. Leading growth stocks are generally acting weak and there’s a lot of pessimism about third-quarter earnings season. In an environment like this, I’m in no rush to buy high-quality names seemingly on sale. They could easily head lower from here.

Simply put, the risk outweighs the reward.

TOP DOWN APPROACH

I’m a top-down investor which means I pay a lot of attention to price and volume in the major averages. During market uptrends, I put money to work. When I start to see signs of institutional selling in the major averages, I scale back. In recent days, my Ultimate Growth Stocks model portfolio has gone from being 60% invested to 40% invested.

OUTPERFORMANCE

Right now, I’m paying attention to growth names holding up the best. It’s not a sure thing they’ll be leaders going forward, but stocks showing resilience in a down market are always worthy of your watch list, especially when there’s a fundamental story driving share performance.

TOP PICK

One name that fits the bill is Jazz Pharmaceuticals (JAZZ). It has a market capitalization of $3.3 billion and an average daily of close to 900,000 shares. Its key drug is Xyrem used to treat excessive daytime sleepiness in patients with narcolepsy. Earnings aren’t due until early November, but another strong quarter of growth is expected with third-quarter profit up 40% to $1.32 a share. Sales are seen rising 145% to $179.9 million. In the second quarter, Xyrem sales totaled $89 million, or close to 70% of total revenue.

IMPRESSIVE TECHNICALS

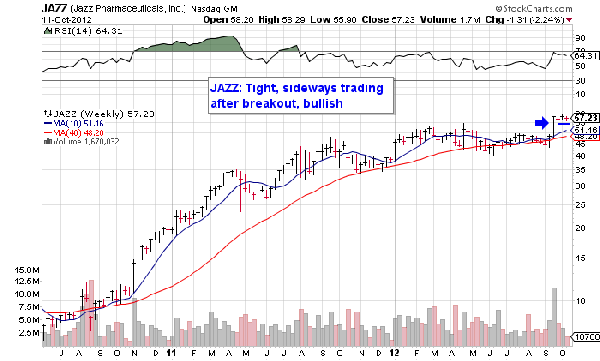

Jazz’s chart looks solid. Shares soared nearly 15% on Sept. 17 after a federal judge ruled favorably for Jazz in a Xyrem patent suit it had against Roxane Laboratories. Its weekly chart shows tight, sideways trading which is a sign of strength and support. Shares remain under accumulation, and I believe this name has the potential to outperform going forward. Due to the current unsettled nature of the market, I’m not interested in owning Jazz right now, but its fundamental and technical picture is compelling.

= = =

[Editor’s note: Read more about Shreves Ultimate Growth Stocks model here. ]