The S&P 500 mini-futures (ES) took a pretty good hit yesterday, down 17 points to close at 2099, below the psychologically significant 2100 level for the first time in recent weeks. The result would have been worse except for the usual end-of-day ramp that lent an air of tattered respectability to a market that was trying hard to get back above 2100.

We had a narrow daily range on Tuesday, followed by a wider range on Wednesday, which is a sequence that is very familiar to traders. Typically it provides good trading opportunities.

The nominal cause of the turmoil is the continuing Greek debt drama. Greece has failed to make a payment due today (Friday) using an obscure provision last used by Zambia in the 1980s that allows it to pay all of June’s debts at the end of the month.

That payment and another 750 million Euros due later this month will probably not be made, initiating a default process that will roll out over the next six week. We aren’t done with this folks.

Today

The market driver today (Friday) will be the Non-Farm Payrolls, which will be released at 8:30 this morning (or, as has happened recently, be leaked a few milli-seconds earlier so the machines can get a jump on the rest of us).

The mini-futures traded down as low as 2092 in the Globex session, but a “good” NFP print (i.e. anything below 200,000) will boost the futures quickly. The consensus is for a print around 225,000.

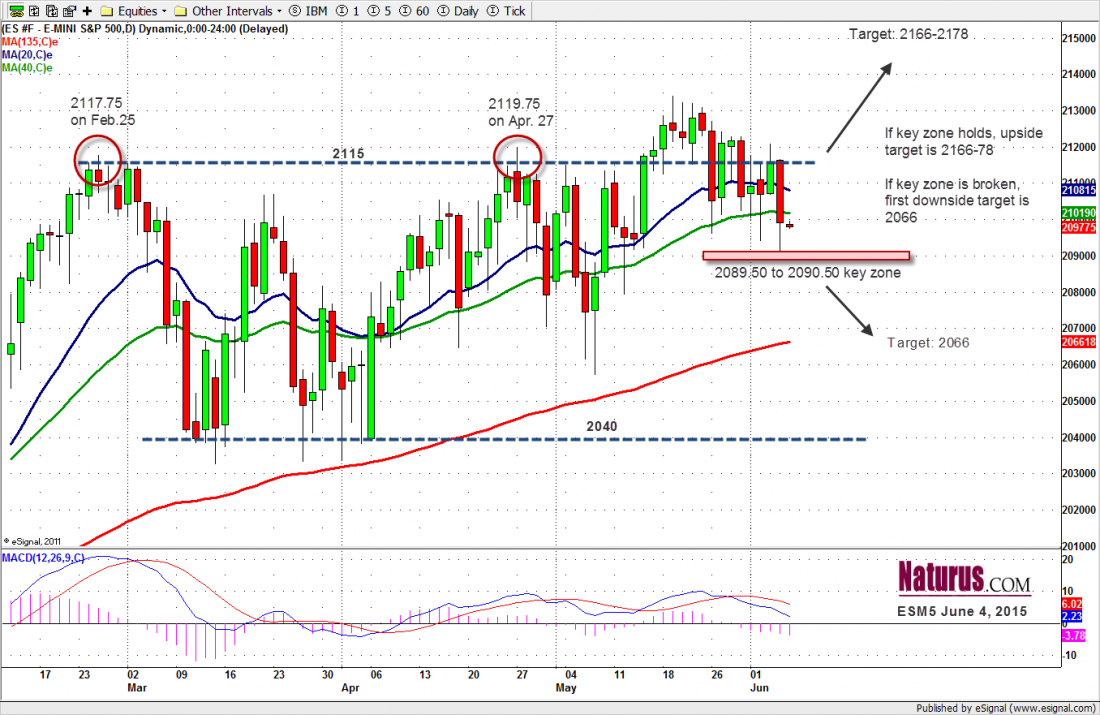

The key zone today is 2089-2091. Yesterday the decline stopped right above that key zone and ran back to 2099 for closing. Today this key zone will remain an important decision level.

As long as the price stays above it, ES will struggle to close near 2100 level. Otherwise it will go further down to the 2075-2065 zone if price breaks below 2087. That will also confirm that 2134 will be the short-term top for minor correction.

On the upside, as long as ES doesn’t exceed the 2107 level, the seasonal bias favors the downside.

Major support levels for Friday: 2092-89, 2081.50-79.50, 2062-59.50’

the major resistance levels: 2123.50-2121.75, 2134-36.60

To receive free market insights with actionable strategies from naturus.com, click here

Chart:

ESM5 Daily Chart, June 4, 2015