S&P 500: We’ve seen this movie before. And we don’t like the way it turns out.

See if this sounds familiar: an unexpected event roils the equity markets. Prices crash dramatically, perhaps as much as 100 points in the S&P in a couple of hours. Then, in the next couple of days, the market recovers and the price marches straight back up to where it was, in a V-shaped recovery on relatively light volume. Within a week or two everything is back to “normal” and the crisis-du-jour is forgotten … until the next one.

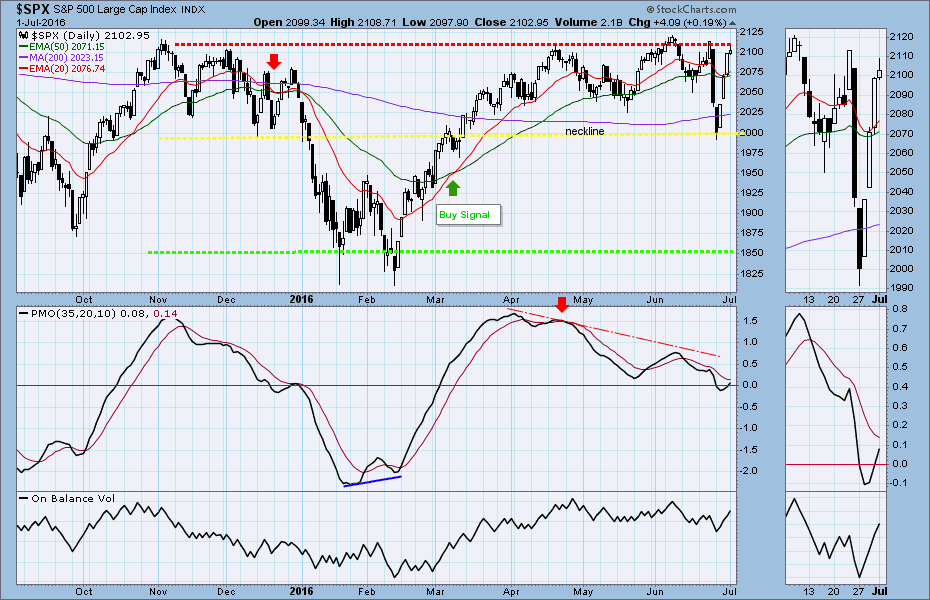

It happened again last week. The Brexit crisis. The SPX down 100 points in a day. More declines when the market opened Monday. Then the magical levitation back up to where we were before the British voted to pull out if the European Union. Over the weekend the market even flirted with our old friend, the 2100 level on the futures, as it has done a dozen times since May of 2015.

The problem is that nothing is ever resolved. For more than a year the market has lived in a limbo where it can’t go up to make new highs, and is not allowed to decline below the current consolidation range — a market that “cannot live yet never dies,” to paraphrase Billie Holliday.

We’ve seen this movie before, and we don’t like the way it turns out. The endless stimulus in various forms from the Central Bankers, including the Fed, props the whole tottering edifice up for another couple of weeks or months, but nothing – and especially not the mountain of bad debts that are burying European banks – is ever fixed.

The Masters of the Universe succeed in keeping financial assets from declining, but at the price of stagnation or worse in the real-world economy. And it is happening everywhere in the world, including the USA.

Want an example? Look at Caterpillar (CAT), a great company and a jewel in America’s manufacturing sector. It traded Friday at $76.50 a share, down a little from a year ago, but well above the recent low.

Caterpillar’s world-wide retail sales have declined year-over-year for 42 consecutive months, an event that has never happened before in the company’s history. It is not just the US; it is the world economy that is sliding away.

If/when it does, who is going to buy Caterpillar’s bulldozers?

This week

It may be The End of the World As We Know It (TEOTWAWKI) but it won’t happen before Friday. The rally by the SPX last week was remarkable. Some might say unbelievable.

The SP500 cash index not only regained control of the 200-day moving average line, an important support level, it also regained the short-term momentum support lines (20/40ema lines) early in the week to trigger buying programs.

But now the market looks toppy in the very short-term. The 2125-2134 zone is long-term resistance, which has held the index down for the past 11 months. This is the point where the rally must continue. Or stall.

A failure to see a follow-through rally this week could lead the index to have a minor pullback.

Today

For the S&P500 mini futures (ES):

The ES fully recovered from the waterfall decline initiated by the Brexit result. It closed above 2089, the major Brexit broken support level last Friday and now tries to signal a bullish outlook. Over the weekend it touched 2104.

But don’t be fooled by the appearance of a robust recovery. A news breakout move will often return to re-test its starting point and that might happen with the ES.

So far the ES is still contained its long-term consolidation range. It would have to break above last May’s high at the 2134 level and move up around 2150 for confirmation before it can give a bullish continuation outlook.

But last Friday’s price action and trading over the weekend looked like an exhaustion move, and could be the start of range-bound trading for a while.

Today 2086.50-83.50 will be a key zone. A failure to hold it could lead the price to fall to 2078-75 or lower to 2068 area to bail out the former Brexit shorts.

2110-15 will be the first resistance. A move above this resistance line could push the price up to 2120-23.50 to bail out the former buyers around 2118-15.75 who believed the UK would not exit EU … until the vote showed otherwise.

Major support levels: 2050-55, 2000-1998.50, 1985-83, 1975-73

Major resistance levels: 2107.50-10.50 , 2120-23.50, 2138-39.50

Visit Naturus.com to see detailed previews for gold and the ES for the week ahead. Free.