By: Scott Redler

…Not the Indices

Rotation in the market has been king. You cannot overstay your welcome in any one sector and you have to make sure to keep following the money. You buy a move on day 1 and hold it through day 2, but on day 3 you need to be out of most of your position. By day 4 (if there is a day 4) maybe start shorting in small size.

The Banks had four up days in a row and need to digest–we have to see how much of a pull in they have in order to consider them for another move higher. Goldman Sachs (GS) had a 4 day upmove, leading the entire sector, and rightfully took yesterday off. The group held strong despite the downgrade by Meredith Whitney. As long as Goldman holds over half of that upmove, we will buy the dip and add as it breaks above the new range.

Bank of America (BAC) is opening higher on an upgrade from CSFB. We are selling into the strength. It is day 4 on the move and goes perfectly with my example above.

The Rundown:

- Casinos held in well after a monster two day move in Wynn Resorts (WYNN), Las Vegas Sands (LVS) and MGM (MGM). They look to have more upside potential here.

- Commodities had a monster move–the OIH is sitting near new highs and oil ripped higher. I would not enter a trade in either at the moment as they are extended to the upside. They need to consolidate this latest move.

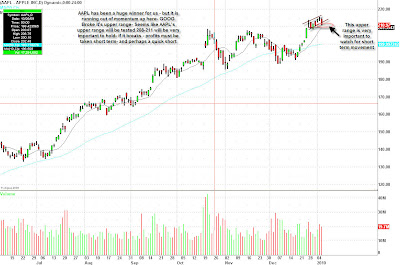

- Big cap tech is feeling some pressure right now. Google (GOOG) was our chief concern yesterday–they sold the Nexus news–then the stock broke its upper range of $620-622. Traders need to notice this!

- Amazon (AMZN) still can’t find support after its double top lower high. Priceline (PCLN) also got hit.

- RETAILERS ARE UP BIG THIS MORNING–I am not a buyer

- The GLD that we bought–corresponding to a $1,080 average in the gold futures–had a nice bounce. We sold half of our position into the move at around $1,130 on the futures and are hanging onto half as there is still room to the upside.

- The solar sector has been hot–First Solar (FSLR) above $135.10 might be worth a trade.