Anybody in the mood to go to the bank?

With the financial world being shaken every time anyone in the Federal Reserve speaks it’s hard to imagine being able to profit while trading stocks in the financial sector, especially long term. It’s always “Europe this,” “Greece that,” “China manipulating their currency”…it just feels unstable.

Personally, I don’t bank at Bank of America. I don’t like big banks. For me, there’s too much bureaucracy, red tape and long holds on your account, just to accomplish something as simple as a change of address. But that doesn’t mean I can’t trade the stock.

PRICE DISCOUNTS EVERYTHING

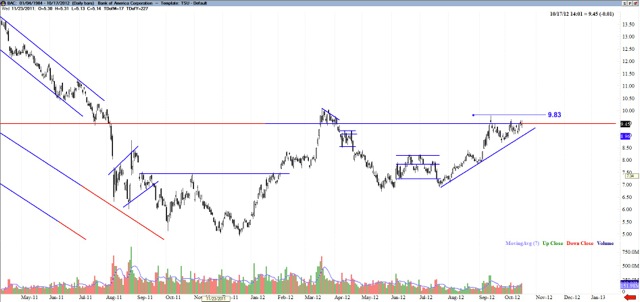

I see a long term trade potentially forming on Bank of America (BAC). It’s something that Warren Buffett saw over a year ago. As it stands right now, Bank of America is totally neutral. If you’ve read any of my blog posts before, you’ve heard me state the first tenet of Dow Theory: The Price Discounts Everything. Given this, let me show you what I’m seeing in this chart and where a good location to buy might be.

THE SET-UP

Recently, we have had a string of higher lows and lower highs, forming a potential triangle pattern. There is very strong resistance around $9.50. We have pierced that level a few times but don’t hang above it for very long. So, I would like to see a nice close above $9.83 with strong volume. (This potentially could be a great stock play, as well.)

CONFIRMATION

All oscillators are neutral, Bollinger Bands are sideways. This very well could be a longer term trade and to take advantage, one could sell covered calls at points of strong resistance.

TARGETING AND RISK MANAGEMENT

There is a fairly strong first target at $11.00, then another at $12.75. To mitigate my risk, I would place my stop below $9.50, if this trade actually triggers.

= = =

Watch Brian Shannon’s video analysis on bank stocks here.