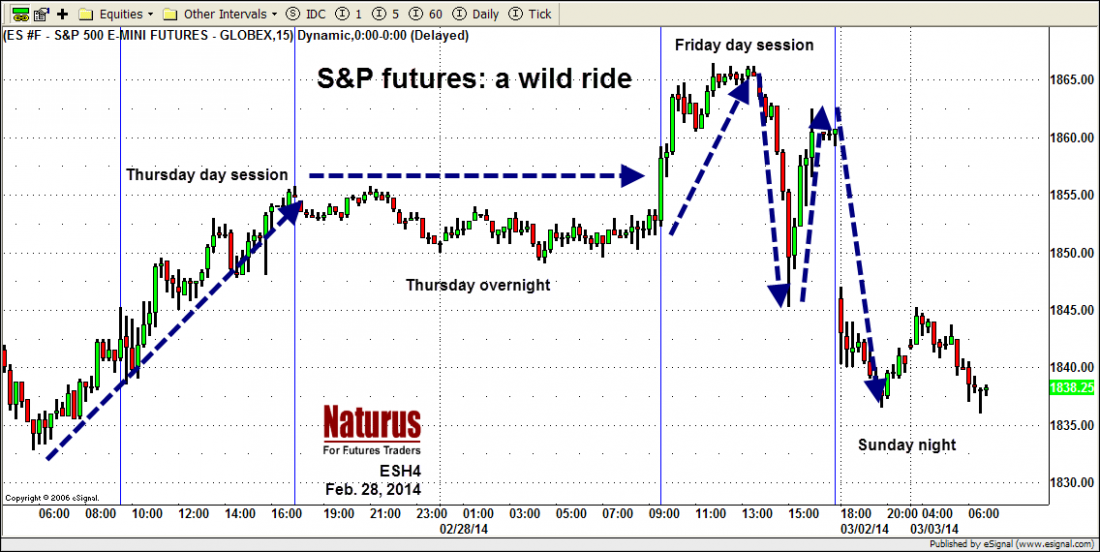

The end of last week was a wild ride for the stock index futures. The S&P 500 mini-futures (ESH4) were all over the map (see chart): up 30 points in two days; down 20 points in an hour; up 15 points in the next 20 minutes; and down 25 points when the after-hours market re-opened Sunday night.

A lot of that was the Battle of the Bots – a war between contending super-computers to set the closing price for the end of the month. But cranking it up was obviously a lot more difficult than usual.

So what is going on, and what will happen next?

What Happens Next?

Our best guess is still only a guess; this market will be driven by the news from Europe, as Russia and the West face off across the Ukraine.

But for the short-term, we think bad news – the prospect of war – will be bad for the markets. Long-term, not so much. Here is our reasoning.

War is thought to be good for business – “Buy when the cannons are firing,” Baron Nathan Rothschild famously advised his London traders after the last war in Crimea – but initially at least it is not good for the market. It adds uncertainty, and when traders get fearful they run and hide.

Given that in our view the broader market is now dangerously overbought and over-priced, we think there will be a short-term sell-off.

Longer-term, we are still bullish; we thing a logical resistance area for the index futures is north of 1920 and that we will get there sooner rather than later.

How Far, And When?

The cash index (SPX) made new all-time highs Friday, following a sell-off in January and a dramatic rally in February. So far there is no major strong reversal signal on the short-term uptrend. But the down-and-up moves ran a lot of stops, and those people will not be rushing back into the market.

Normally, we would expect sentiment to be bullish at this point; right now we think traders will be cautious, especially given the news from Europe.

So we are looking for resistance around 1871 and support around 1835 – 1829 and 1809 in the ESH4. The trading strategy is sell the resistance, cover at the support.

Longer Term

Longer term, we are looking for a move above 1877.50 in the SPX. That will confirm that the next target should be around 1930-40, provided the short-term pullback does not seriously break current support levels.

If/when there is a peaceful resolution of the current European stand-off – which is what we expect – there will be a return to the buy-the-dip mentality that has been driving the market higher.

The broader market has just broken out of a 10-year range. This year the break-out from that range gives us a first target in the futures around 1920-30 and a second target around 2050. For the longer term, we see a target in the 2,500 range.

But not this year.

= = =

Readers who want a more detailed analysis can get a free copy of the Naturus outlook for the coming week at this link: http://members.naturus.com