Cliff’s Natural Resources is not the company that makes Clif bars. I would be telling a small fib if I told you a few weeks ago, I didn’t think they were related somehow.

GOOD TRADING STOCK

Regardless of my non-inquisitive nature at times, many investors, both long and short term, love trading CLF. It’s volatile, pays dividends, has high liquidity, and is option-able.

A LOOK BACK

CLF has, however, lost more than 80% of its overall value in the last two years. Call me wild and unique but that is one massive drop in value.

Back in 2008 (it’s most recent fall from glory) CLF stated a one-year accumulation phase around the $20.00 area, trading all the way down to $12.00 before forming an inverted head and shoulders and increasing in price by more than 600%. That’s a radical return.

REVERSAL IN THE MIDST?

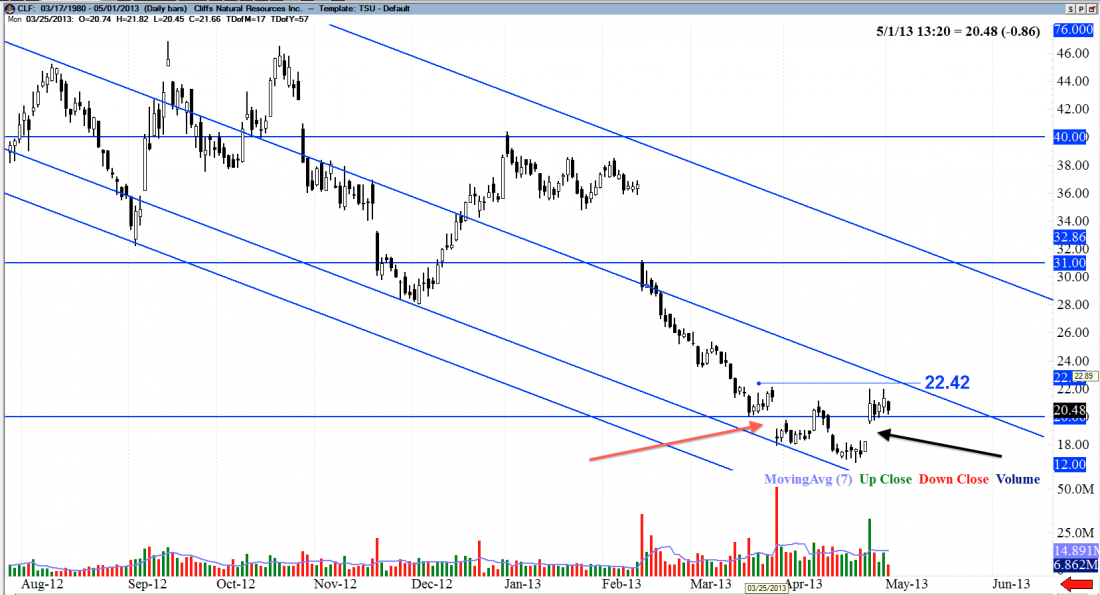

CLF has been in a strong downtrend since August of 2011. I believe early reversal signs are showing. First, we have a big gap with massive bearish volume. Many would consider that to be a bearish sign. Well, the fact remains, that bearish gap has now filled and a bullish gap has been created.

ISLAND REVERSAL

This shows the potential of an “island reversal pattern.” An island reversal pattern is a strong reversal signal, where you have an exhaustion gap, shown by the red arrow and a breakaway gap, shown by the black arrow.

We are running into a bearish down trendline and CLF will have the 100 and 200-day simple moving averages to contend with. The stock is also below the 50-day exponential moving average.

KEY LEVELS

If we get a close above $22.42, that could be a solid location to begin taking on some longer term positions. It would be best to wait potentially a few more days, perhaps around May 6th.

If the trade triggers after that, the 50-EMA will have had time to either a) push the stock back down bearish or b) fail as a strong resistance. If we fill the gap denoted by the black arrow, CLF will continue its bearish trend, likely back down to the $12.00 region.

COVERED CALLS

If you do purchase shares around this price, you could consider selling covered calls as we trade sideways, during what could shape up as a long term accumulation phase.

Steel and metal companies right now have really been in a bearish trend overall. This could be the last bearish thrust or simply a retracement. Regardless, mitigate your risk as always.