I saw a blog post over the weekend talking about all the long set-ups out there. While I agree that plenty of growth names continue to show relative price strength and overall strong technical action, it doesn’t mean they’re still within buying range. After a big run for the market, there are a lot of extended names out there.

During a quick scan of my growth screens over the weekend, I found some base-building stocks but they’re not exactly a dime a dozen at the moment. I’ve been putting money to work recently but have taken my foot off the accelerator in recent days.

FOR YOUR WATCH LIST

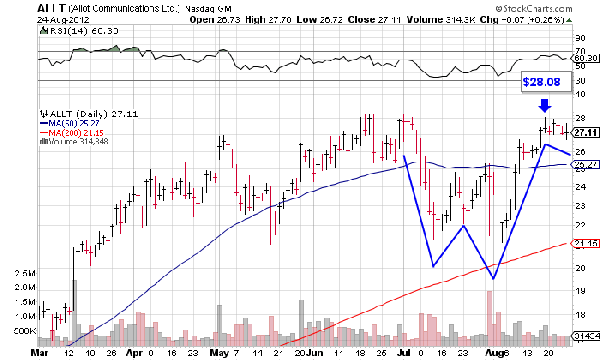

One name I’m still watching with potential is Allot Communications (ALLT). With a market capitalization of just over $800 million, it’s not a widely-known name in the networking space but it has a lot of positive qualities from a fundamental and technical perspective.

FUNDAMENTALS

The company makes network optimization hardware and software. In its latest reported quarter, profit rose 50% from a year ago to $0.15 a share. Sales rose 43% to $26.4 million. Revenue growth has been accelerating in recent quarters, always a good sign because it indicates strong demand for a company’s products. In the second quarter, 40% of its revenue came from Europe, the Middle East and Africa (EMEA), down from 73% in the first quarter. Revenue from the Americas rose to 38% from 14%.

KEY LEVEL TO WATCH

There was a lot of institutional selling in Allot between July 9 and August 2 but the stock has recovered nicely and could be getting into position for a technical breakout over $28.08. If it breaks out, look for volume of at least 200,000 shares during the first two hours of trading. Allot normally trades about 475,000 shares a day. The stock isn’t under meaningful accumulation yet but could be soon if more money comes in from the sidelines.

BOTTOM LINE

When it comes to the broad market, I’m a top-down investor so I pay a lot of attention to price and volume in the major averages. I buy stocks during market uptrends and raise cash during downtrends. Major averages remain in uptrends and aren’t showing much in the way of sell signals so I’m in no hurry to sell my strongest performers. My Ultimate Growth Stocks model portfolio is well positioned at the moment –about 60% invested with several names that look like emerging leaders.