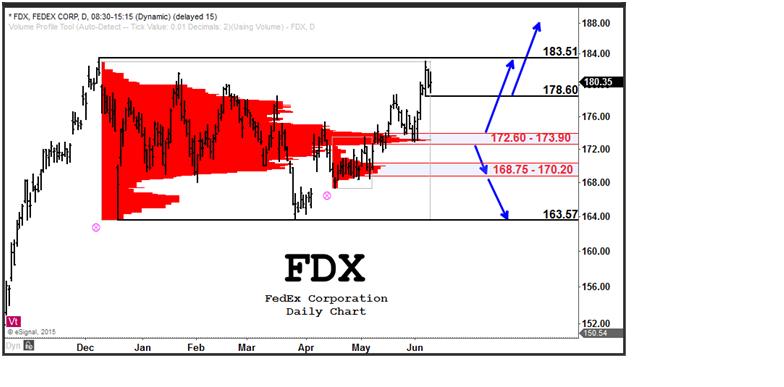

As traders begin considering positions for FedEx’s (FDX) earnings release next week on 6/17, here are the prices that FDX traders have established as important.

Last year’s early December high at 183.51 is within striking distance. A move above 183.51 would send a strong bullish message that FedEx prices are headed to higher levels. After 6 months of rotating within the current $20 range, a move out of this range could be a catalyst to a sustained move.

The recent push higher off 178.60 establishes that level as a nearby level of buying interest and support from a short-term perspective with the much more robust zone of support, as revealed by the volume profile, being at 172.60 – 173.90. It is this high volume area that I consider the dividing line between giving the bulls the advantage at an eventual upside resolution versus giving the bears the advantage at an eventual downside break.

As earnings approaches, and with prices testing the highest levels so far this year, the line in the sand is clear. While prices in the 180’s represents an extreme in the context of the last 6 months, unless the nearby support at 178.60 is breached, the current price action gives the advantage to the bulls. If traders are not ready to take prices higher at this time, we’ll know that when 178.60 is breached. But there’s no reason to begin becoming bearish FDX unless the key zone at 172.60 – 173.90 is taken out.

Volume‐at‐price is valuable tool similar in some ways to Market Profile, which utilizes time‐at‐price. Volume‐at‐price is displayed as a histogram along the price (vertical) scale and builds across the chart as traded volume occurs at each price. This view is sometimes referred to as a volume profile or volume‐at-price.

Volume‐at‐price analysis provides valuable information about what prices have seen the heaviest institutional interest and can give insight into where the smart money is accumulating and distributing. While traditional indicators are often simply derivations of price information, volume‐at‐price provides unique additional information that is not available to traders only using traditional technical analysis methods.

If you are interested in learning the value of volume-at-price information, check out this link.