GRMN (Garmin Ltd.) spiked lower following Apple’s (AAPL) watch announcement. The news of AAPL’s new watch caused GRMN to start selling off and created some volatility that I could possibly capitalize on.

Start The Analysis

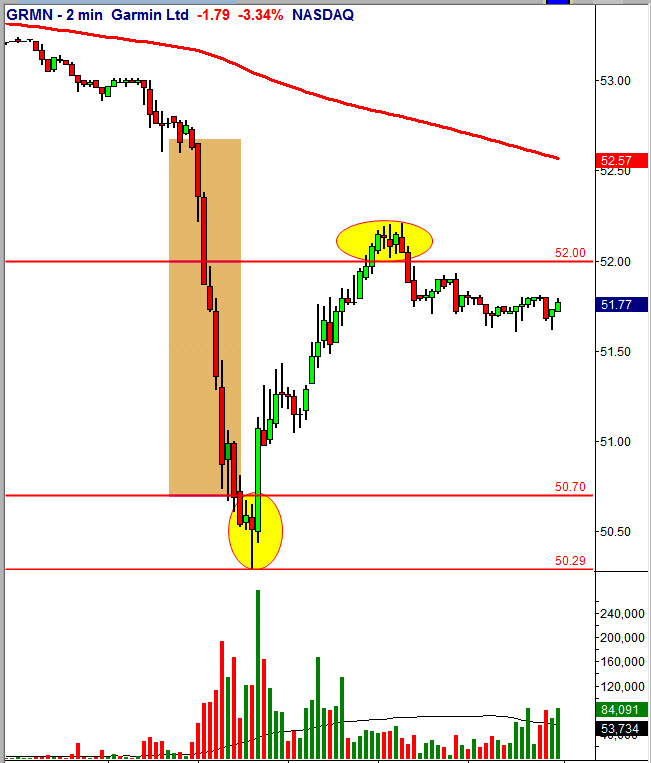

My first objective in seeing a stock selling off in the middle of the trading day is to figure out where longer term support/demand exists to eye a potential bounce. Using the daily chart, I spotted the area of $50.30 from the 2/19/2014 gap up day as being some demand. By establishing the demand levels I then dialed down to the two minute chart and looked for a reversal bar to form into $50.30 for entry.

After eleven two minute bars dropped lower on the sell off a two minute bar formed with a bottoming tail which gave me an entry of $50.70 and placed my stop under the day’s low at $50.25. The entry minus the stop gave me a risk of .45 if stopped out.

Trade Spot

Nailing the entry on GRMN at $50.70 it never looked back and bounced real nicely into $52.00 where I finally trailed out gaining $1.30 and $2.88 times our risk amount of $0.45.

Key Takeaway

When playing volatility spikes in the afternoon know your support levels, watch for reversals on the smaller time frames for entry, and find a decent trailing method to keep the gains coming.

= = =

To learn more about trading volatility spikes here: www.gapedgetrading.com