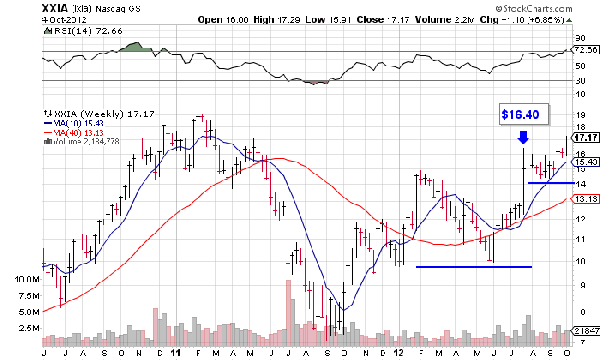

I first bought shares of Ixia (XXIA), a small-cap maker of network-testing equipment, on Sept. 19 at $16.30. It finished the day at $16.42, up 5.9%. Volume exploded to 1.3 million shares, well above its average daily volume of 465,000 shares. I generally like to buy when institutions are buying, and they were definitely buying on that day.

OLD MARKET ADAGE

There’s a saying a stock can either scare you out or wear you out. Investors can get scared out of a stock if, for example, it suffers a sharp percentage decline in huge volume. Investors can also get worn out if trading starts to get dull and uneventful.

RECENT ACTION

Ixia didn’t make much progress after its September breakout attempt. In fact, trading got downright boring as the stock moved sideways in light volume. Even though it was frustrating to watch, I knew it was constructive action so I stuck with it and gave it some time to work, realizing that another breakout could be in the works.

KEY BREAKOUT

On Thursday, Ixia cleared a bullish base-on-base pattern with conviction, rising 6.6% to $17.17. I added another 200 shares to my 800-share position, buying more at $16.90. My average cost basis went up modestly from $16.30 to $16.42.

HOW IT WORKS

A base-on-base pattern forms when a stock breaks out of base, rallies less than 20%, then forms a second base on top of the prior base. Ixia initially broke out in late July over $14.87.

IT’S GOT IT ALL

Whenever I decide to add a stock to my Ultimate Growth Stocks model portfolio, it’s always because of strong fundamentals and technicals. Ixia is strong in both areas. This year, it’s expected to earn $0.74 a share, up 25% from 2011. In 2013, earnings should be up 24% to $0.92 a share. No official earnings date yet from Ixia but it should be on or around Oct. 18.

ADD TO WINNERS

I’ll look to add to the position again if it forms a new base from here or comes to its 10-week moving average ($15.43) and finds support.

= = =

Looking for more trading ideas? Read out daily Markets section here.

Editor’s note: Learn more about Shreve’s growth stocks newsletter here.]