As a growth investor, my goal is to buy a stock with strong fundamentals and technicals in the early stages of a move. Three-plus years into a bull market, they’re not easy to find, but several new issues fit the bill, including high-end apparel designer Michael Kors (KORS).

A common pitfall for investors is to chase a stock and buy after a huge price run already. Michael Kors isn’t in this boat because it went public in December at $20. It’s been a standout performer ever since, and I still believe this high-quality name could still be in the early stages of an upward move. It has the look of an emerging leader.

In September, KORS raised its fiscal second-quarter and full-year earnings and revenue guidance. It also said quarter-to-date same-store sales, for the 11 weeks ended Sept. 15, increased 45%. Try to find another company with same-store sales growth as strong as that. You won’t.

Fiscal second-quarter Earnings are due Nov. 13. The consensus estimate calls for profit of $0.40 a share, up 74% from a year ago with sales up 70% to $519.3 million.

Great opportunities arise in the stock market when bullish fundamentals and technicals collide, and it’s happening now in KORS. Annual return on equity is huge at 56%. You’d think short sellers would be all over a stock selling at 58 times trailing earnings and 30 times forward earnings, but they’re not. As of October 15, 4.2 million shares were held short, but that’s not a lot considering it trades about 3.5 million shares a day.

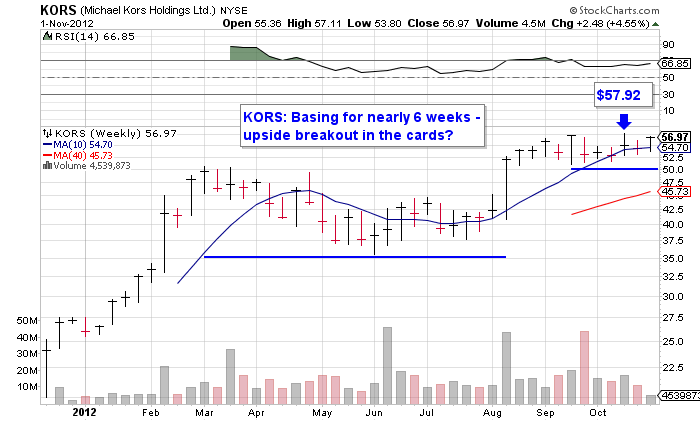

After a technical breakout in mid-August, KORs has been consolidating gains for nearly six weeks, taking a breather and firming up at its 10-week moving average. Buyers were in the stock Friday and shares outperformed, rising 4.2% to $56.97. Keep an eye on this name for a possible heavy-volume breakout over its recent high of $57.92.

= = =