I’ve profiled a couple of retailers in this space recently: Ulta Beauty (ULTA) last month when it was setting up in a bullish cup-with-handle base, and farm-equipment retailer Tractor Supply (TSCO) last week just before it staged a bullish technical breakout over $101.28.

CHART UPDATE

Ulta Beauty’s chart still looks solid. It’s been firming up at its 10-week moving average, in position for a possible breakout attempt over $103.52.

GOOD UNDERLYING FUNDAMENTALS

The retail sector isn’t easy to play due to consumers’ fickle tastes, but if you focus on stocks with a consistent track record of earnings and sales growth — with strong relative price performance to boot — the odds are more in your favor for a profitable trade.

INSTITUTIONAL BUYING

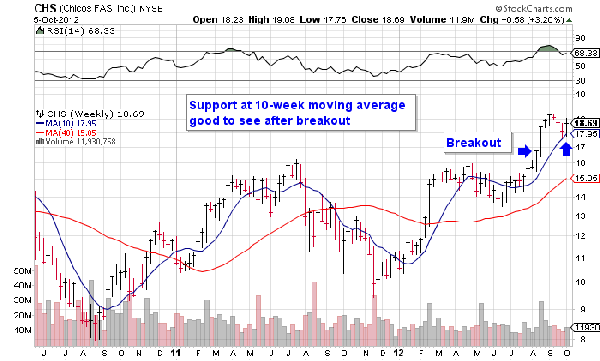

Shares of women’s retailer Chico’s FAS (CHS) have been under accumulation in recent weeks. When a stock is under accumulation, it’s not hard to find several above-average price gains which is a generally a sign of institutional buying.

KEY LEVELS

Chico’s staged a technical breakout in mid-August over $16. Shares closed Friday at $18.69, but the good news is that it’s not too late to buy. After a stock breaks out, it’s common for it to take a breather and come down to its 10-week moving average. Chico’s FAS enjoyed a nice bounce off the line last week which puts the stock in buying range again. Weekly volume totaled 11.9 million shares, nicely above the prior week’s level of 9 million shares.

Even though I like to buy focus my buys when a stock breaks out of an initial base, buying after a successful pullback to the 10-week MA is sound strategy — just make it a smaller-than-normal position to start.

AHEAD OF EARNINGS

Earnings aren’t due until November so there’s some time to let this trade work. Quarterly profit is seen rising 22% from a year ago to $0.22 a share with sales up 17% to $631.9 million.

= = =

More of Ken’s stock picks here:

Move over Google and Baidu, check out Russian player: Yandex