The S&P 500 e-mini (ES) made a continuation high move yesterday (Wednesday) following the minor gain from the prior day. The price moved up in overnight trading, and rallied strongly after the US open. It stayed up all day to close near the high.

The price reacted strongly to news/rumors from Germany suggesting a way out of the Greek debt drama. The price moved past the 2098 resistance to trigger a strong upside momentum run. By the end of trading the ES gained about 27 points to close at 2107.00

Today

Yesterday’s movement was bullish, and accompanied by high volume. Today we want to see a follow-through and hold ES above the 2099 level. A move below 2098.00 could restart the decline and push the price back down to the 2088-90 area.

In the early session the Jobless claims and the Retail Sales reports will help to move the price. If overnight trading goes low first, it is likely to see ES to bounce back up later. Buying on the dips will likely continue today.

The 135-day moving average line area (2066-2062.50 zone) needs to hold up the September contract. Today is a rollover day. The June contract will approach the SP500 cash index price. On Friday trading will switch to the September contract. Buying on dip will continue today.

Major support levels for Thursday: 2072.50-68.50, 2062-59.50

major resistance levels: 2116-18.50, 2123.50-2121.75, 2134-36.60 and none

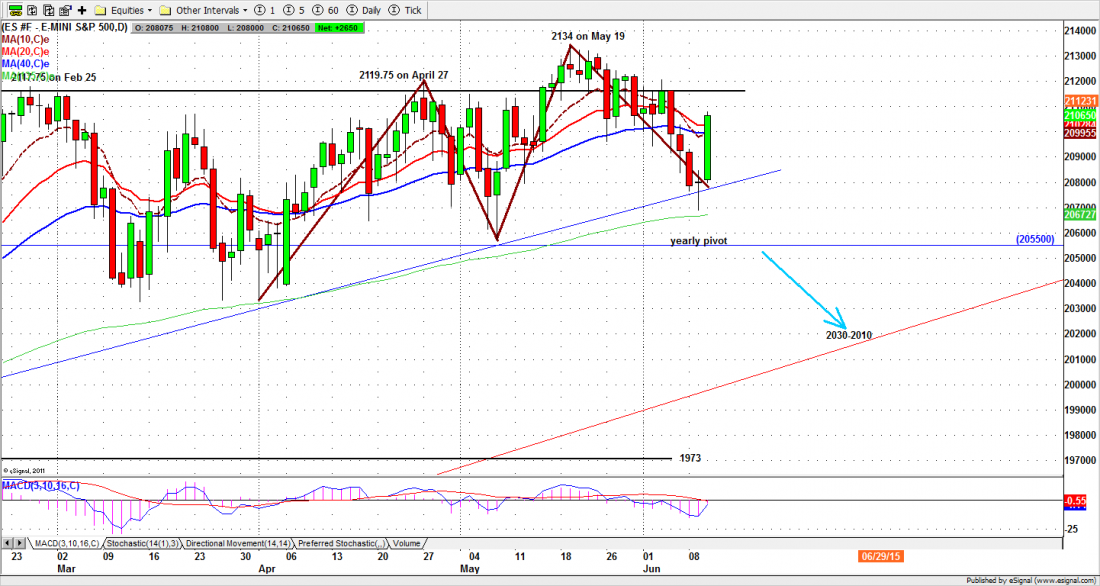

Chart: ESM5 Daily chart, June 10, 2015