Many times I have heard my trading mentor Jim Dalton describe support levels as a wet paper towel. The more times you poke at it, the weaker it becomes.

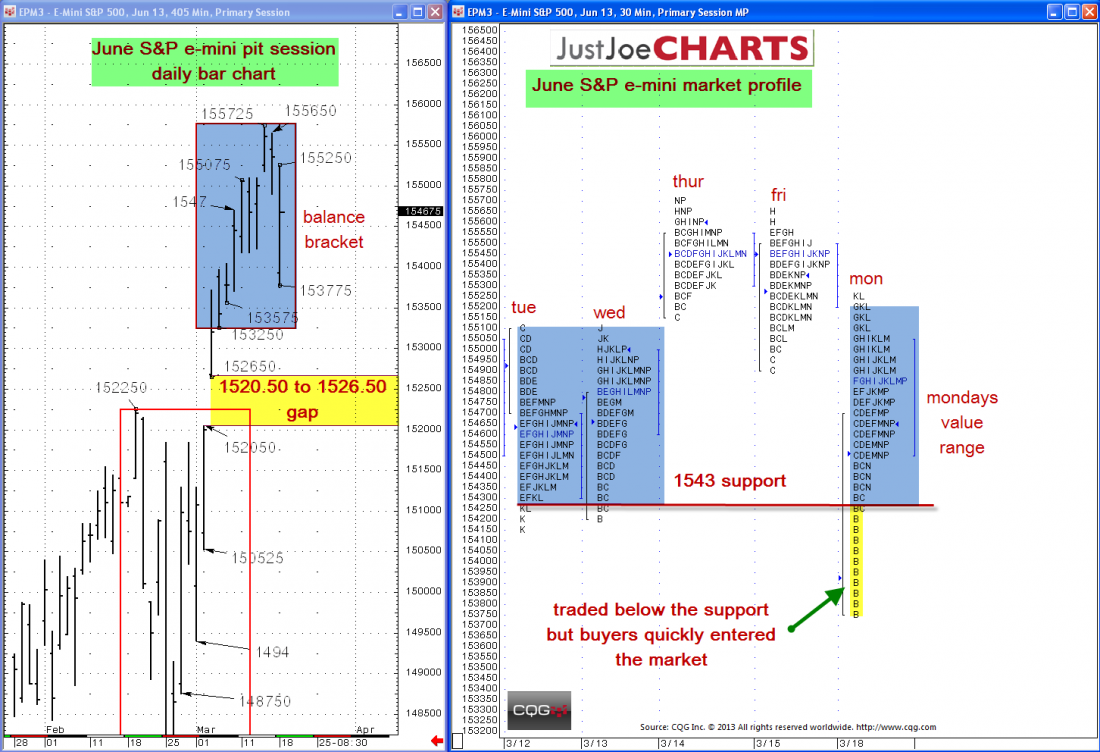

After equal or higher value for nine consecutive days, the June S&P E-mini contract has lower value over the past two days. The market is now trading within a 1532.50 to 1557.25 balance bracket over the past 10 days. Additionally, there is a 1520.50 to 1526.50 gap below the balance bracket.

On Monday, the market gapped open lower, traded below an important 1543 support level, but buyers quickly brought the market back above that level and 1543 again became support for the rest of the day.

BREAKING THE SUPPORT LEVEL

The market has poked at that key support level four times over the last six days. If the market spends some time below that 1543 support level, it may test the 1532.50 balance bracket low. If the market gains acceotance below the 1532.50 balance bracket low, the 1520.50 to 1526.50 gap becomes the target.

RESUMING THE UPSIDE MOVEMENT

After the initial downside move on Monday, the market found a a value range of 1543 to 1553 to rotate within. In order for the market to resume the upword trend, the market must gain acceptance above Mondays value range. If the market, gains acceptance above Mondays value range, it may test the 1557.25 balance bracket high. Additionally, if the market gains acceptance above the 1557.25 balance bracket high, the next upside reference on the weekly bar chart is 1576.

Be patient entering a trade as most times it is better to be a little late entering a trade than a little early.

[Editor’s note: Click here for info on a two-week free trial to analysis by JustJoeCharts. ]