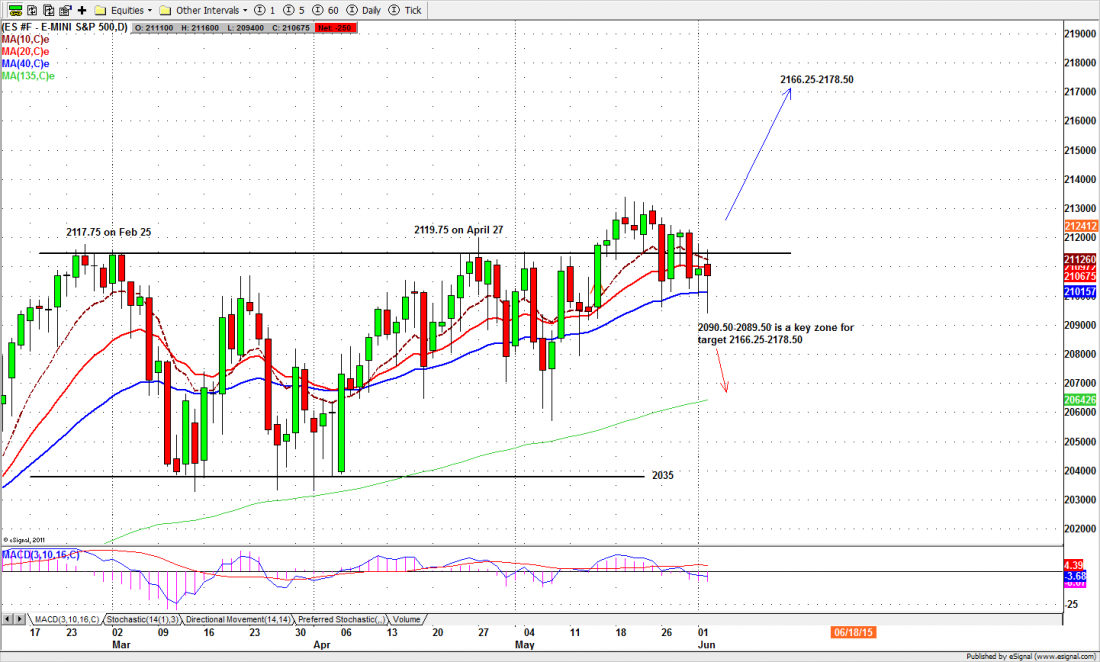

The S&P 500 mini-futures (ES) closed at 2106.75 yesterday (Tuesday) down a little more than two points from the previous close, after a day of trading that resembled nothing so much as the day that preceded it.

The ES broke out briefly above the intermediate-term resistance two weeks ago, and ever since has been trying to take it back. We have seen a succession of lower highs and lower lows as the market pulls back inside the broad consolidation range where it has spent all of the spring and the beginning of summer.

It is not like the market is crashing; in fact every dip is being bought, despite negative sentiment. We are just seeing a long, slow grind lower into the summer doldrums.

Yesterday, for example, the market dumped in overnight trading and gapped down for the open, then worked its way back up into positive territory before giving back about half the gain going into the close. Down, up, down. Sound familiar?

This market is just drifting into summer, with no real direction. You can trade it intraday – we do – but nobody is very excited about it.

Today

There may be a little more action today (Wednesday). We have a handful of fairly significant economic reports being released, including the ADP employment numbers, the trade balance, crude inventories (as usual) and the Fed’s beige book.

That might be enough to pump some life back into this limp and bloodless market, although the real action will probably wait until Friday, when Greece and the US employment data will combine to generate a little more volatility.

The odds slightly favor a move down today, but probably not anything very substantial. We’ll be looking for a day that stays pretty much within Tuesday’s range. As long as we close today above 2088, the ES is likely to bounce back on Thursday from any decline today.

Major support levels for Wednesday: 2092-89, 2081.50-79.50, 2062-59.50;

major resistance levels: 2134-36.60

To receive free market insights with actionable strategies from naturus.com, click here

Chart:

ESM5 Daily chart, June 2, 2015