Gap season starts this week with Aloca (AA) announcing their earnings at the close last night. As a gap trader, I am always looking for a catalyst for stocks to gap up or down and earnings gaps can be great trading vehicles.

What to Look for This Earnings Season

Look for stocks that gap and establish a new trend.

As a swing trader I look for gaps establishing a new trend. I call these gaps, “igniting gaps.” For example, if a stock has been in a nice daily downtrend for the last year and a half and gaps up breaking the downtrend line on the daily chart, I wouldn’t look to buy long on the gap up day. I want to see how the stock closes, preferably at the highs, and I want to see excessive volume. An example of excessive volume would be to see a stock that normally trades on average 1.5 million shares a day and trades over 10 million on the gap up earnings day.

An Example

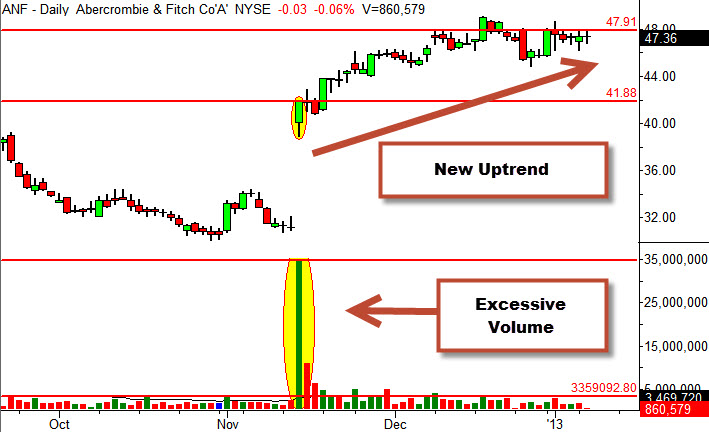

Abercrombie and Fitch (ANF) provides a perfect example of a stock in a downtrend on the daily. ANF gapped up on earnings over a daily pivot with excessive volume. Average daily volume was 3.3 million and it did 35 million. It also closed at the high of the day. The gap up day provided a new anchor of price support for it to grind higher and establish a new trend. This type of gap up on earnings creates a great vehicle for swing trades.

= = =

New Feature Story: