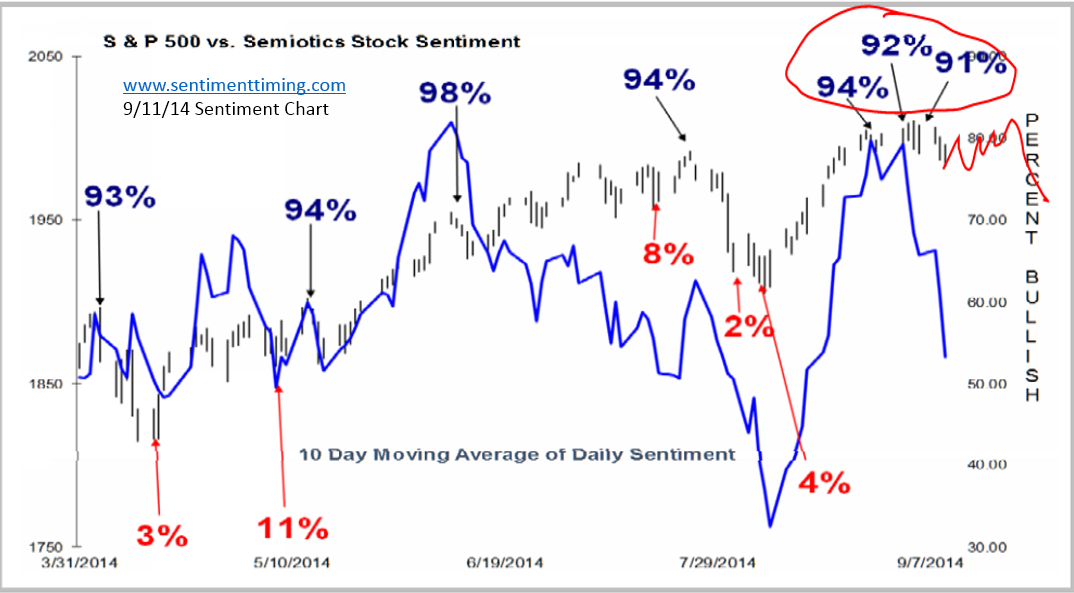

Measuring investor sentiment has always played a big part in my trading.

All trend reversals will almost always take place at sentiment extremes. It is just the way the markets work, when too many are bullish or bearish on the stocks, they will have high odds of reversing the trend shortly after.

I developed a few short term sentiment models that measure how traders are positioning their portfolios with bonds to stocks. When it showed traders were flocking to bonds, it meant fear was in the market. When it reached an extreme either on the greed or fear side, I would then use my regular charting skills to determine where a turn would have the highest odds of playing out.

For the most part, it has worked out very well, in determining when to start looking for a trend reversal, before they actually hit. But the true way to measure investor sentiment has to do with doing actual polling of how investors feel about the market.

I didn’t have the time or resources to do that, so decided to partner with the sentiment master himself, Woody Dorsey. I am going to share what his system is saying now —and what to expect.

The 8/25ish node more or less stopped any upside momentum. Stocks have remained seriously “Sideways,” as we allowed. No change: “Messy, uncertain topping behavior may continue over the next week.” Upside possible but less probable.

Near term timing profiles lack cogency. The next node of note remains due near “9/22.” This may manifest as early as 9/18. There is a cluster of date certain events: FOMC: 9/17, Scotland Vote: 9/18, and the Ali Baba IPO: 9/19. More defined negativity is due in the first two weeks of October.

= = =