Sorry for all the non-trading drama to my blog recently. I’m fairly out of whack right now. My eating, exercise, sleep and caffeine life balance stuff have regressed to where they were before my weekly 5K running routine. I have a ton of work project deadlines all at once and I’m teaching a new class (which is always a ton more work the first semester). This is on top of the move and logistics of getting set up, and some vacation which felt stressful with my big list of things to do… I’m fairly frustrated at this point because I have not even had time to paper trade recently. It’s like I DON’T know how I used to juggle everything, which I did from November through April with some success. Crazy market moves too the last two days. And I’m just skimming the post titles of the blogs, I’m following.

In any case, my computer is now finally configured with everything I need to trade. I am going to paper trade tomorrow using the opening range gapper momentum strategy. It’s been so long now, I will either feel completely lost OR, if I’m lucky, I will see everything with a fresh set of eyes.

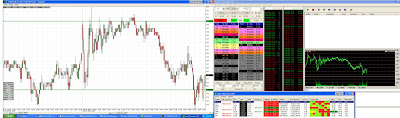

Here is a screen shot of how I have StrategyDesk (charting software) and Laser (trading platform) set up. I’ve decided to only use two screens, and have gotten rid of my laptop in terms of trading (which eliminated another keyboard as well). I’m hoping the simplification and slimming down of moving parts will improve my performance.

The only indicators on my main chart are the fifteen-minute Opening Range Low (ORL) and Opening Range High (ORH). My software places the green lines on the charts at 9:45am every morning. If you are using StrategyDesk from TDAmeritrade, here is the coding for the opening range study.

In the Custom Study Wizard, select new to create two separate studies, one for ORL and another for ORH. Once they are saved as standalone studies, you have to use the overlay study function to add them directly onto the charts. When you do this, you want to make sure that under Options – “Override formula with chart interval” is NOT selected, but while under Show As – “Horizontal’s at last bar’s value” IS selected. Also, this formula doesn’t work when the charts are set to show the extended sessions (don’t display pre or after market price action or things will get out of whack.).

Thanks to StrategyDesk support staff, who were kind enough to write this code at my request last month.

ORH

(Bar[High,15] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 930)) +

(Bar[High,15,1] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 945)) +

(Bar[High,15,2] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1000)) +

(Bar[High,15,3] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1015)) +

(Bar[High,15,4] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1030)) +

(Bar[High,15,5] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1045)) +

(Bar[High,15,6] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1100)) +

(Bar[High,15,7] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1115)) +

(Bar[High,15,8] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1130)) +

(Bar[High,15,9] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1145)) +

(Bar[High,15,10] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1200)) +

(Bar[High,15,11] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1215)) +

(Bar[High,15,12] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1230)) +

(Bar[High,15,13] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1245)) +

(Bar[High,15,14] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1300)) +

(Bar[High,15,15] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1315)) +

(Bar[High,15,16] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1330)) +

(Bar[High,15,17] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1345)) +

(Bar[High,15,18] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1400)) +

(Bar[High,15,19] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1415)) +

(Bar[High,15,20] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1430)) +

(Bar[High,15,21] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1445)) +

(Bar[High,15,22] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1500)) +

(Bar[High,15,23] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1515)) +

(Bar[High,15,24] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1530)) +

(Bar[High,15,25] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1545)) +

(Bar[High,15,26] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1600))ORL

(Bar[Low,15] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 930)) +

(Bar[Low,15,1] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 945)) +

(Bar[Low,15,2] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1000)) +

(Bar[Low,15,3] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1015)) +

(Bar[Low,15,4] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1030)) +

(Bar[Low,15,5] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1045)) +

(Bar[Low,15,6] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1100)) +

(Bar[Low,15,7] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1115)) +

(Bar[Low,15,8] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1130)) +

(Bar[Low,15,9] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1145)) +

(Bar[Low,15,10] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1200)) +

(Bar[Low,15,11] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1215)) +

(Bar[Low,15,12] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1230)) +

(Bar[Low,15,13] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1245)) +

(Bar[Low,15,14] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1300)) +

(Bar[Low,15,15] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1315)) +

(Bar[Low,15,16] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1330)) +

(Bar[Low,15,17] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1345)) +

(Bar[Low,15,18] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1400)) +

(Bar[Low,15,19] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1415)) +

(Bar[Low,15,20] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1430)) +

(Bar[Low,15,21] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1445)) +

(Bar[Low,15,22] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1500)) +

(Bar[Low,15,23] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1515)) +

(Bar[Low,15,24] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1530)) +

(Bar[Low,15,25] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1545)) +

(Bar[Low,15,26] * (Bar[Hour,15] * 100 + Bar[Minute,15] = 1600))