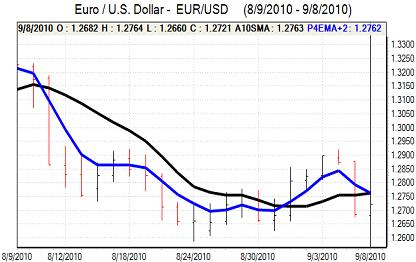

EUR/USD

The Euro remained vulnerable in European trading on Wednesday, but did find support below the 1.27 level as the dollar also found it difficult to gain any significant buying support.

Demand in the latest Euro-zone bond auctions was subdued and yields rose compared with the previous sales which indicated that there were important underlying stresses. There was, however, relief that demand was slightly stronger than expected and this did provide some relief for the Euro. ECB member Weber was also less pessimistic over the liquidity situation in his most recent comments which helped underpin the currency.

There were no major US economic data releases during the day, but there was a further contraction in consumer credit, maintaining the trend seen over the past 2 years. The Federal Reserve released its Beige book and the report suggested that there were widespread signs that growth within the economy had eased over the past few weeks. Confidence in the US economy will certainly remain fragile and strong buying support for the dollar remains unlikely.

There has been no sign of renewed stress in Libor markets and there was no demand for dollars in the latest European bank auctions which will also tend to curb dollar support. Overall confidence in the global economy is still likely to weaken which will provide some defensive support. The Euro nudged back above the 1.27 level, but hit resistance above 1.2750 on Thursday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar remained weak on Wednesday with the US currency hitting fresh 15-year lows below 83.50 against the Japanese currency while the Euro also tested support below 106. Risk appetite stabilised later in the US session and this curbed yen buying support to some extent.

Bank of Japan officials continued to suggest the possibility of intervention to restrain the yen and markets will inevitably remain on high alert for action.

The evidence suggests that there is still strong Chinese demand for Japanese securities which will provide some underlying yen support. There will also be a persistent lack of confidence in the US and Euro-zone economies which will tend to provide default yen protection. The dollar consolidated just below 84 with a reluctance to extend long yen positions given the intervention threat.

Sterling

Sterling gained support in Europe on Wednesday from a stronger than expected Halifax housing report which recorded a 0.2% increase in prices for August compared with expectations of a monthly decline. There was further buying against the Euro which pushed the currency to a high near 1.55 against the dollar before a sharp retreat.

Sterling gained renewed support later in the US session as risk appetite improved while there was also some defensive support for the currency as there was a persistent lack of confidence in the Euro-zone.

The Bank of England interest rate decision will be watched very closely on Thursday. Ahead of the MPC vote, there has been some speculation that there could be a more to fresh quantitative easing. At this stage, it looks more likely that the bank will wait to assess further developments and a decision to hold policy steady would provide some degree of initial Sterling support.

There will still be a lack of confidence in the UK economy which will tend to limit support and it continued to hit selling interest above 1.55 against the US dollar.

Swiss franc

The Euro hit fresh record lows against the franc on Wednesday, weakening to a low point beyond 1.28 as confidence in the Euro-zone debt markets remained weak.

There was some recovery later in US trading with relief that the bond auctions had found reasonable demand while underlying risk appetite also improved.

The franc will continue to gain underlying support from persistent weak sentiment surrounding the Euro-zone and US economies with the Swiss authorities also seen as a staunch defender of currency value in the longer term.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

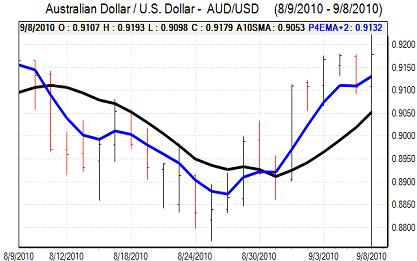

Australian dollar

The Australian dollar was able to resist selling pressure on Wednesday and consolidated above the 0.91 level with a further boost from an improvement in risk appetite.

The Australian labour-market data was stronger than expected with a further employment increase of over 30,000 for August while unemployment fell to 5.1% from 5.3%. The strength of recent employment data has again been in sharp contrast to weaker survey evidence and there will be doubts whether the economic gains are sustainable.

Nevertheless, the combination of firm data and a slight improvement in risk appetite pushed the Australian dollar to a high above the 0.92 level against the US dollar.