EUR/USD

The Euro was unable to break above resistance in the 1.33 area against the dollar ahead of the key events on Thursday and drifted slightly weaker as funds looked to trigger stop losses below 1.3250. As well as caution ahead of the ECB, there was also substantial tensions surrounding Greek negotiations.

As expected, the ECB left interest rates on hold at 1.0% at the monthly meeting. In the press conference following the decision, there was a slight adjustment in the tone from bank President Draghi. The economic outlook was subject to high uncertainty and downside risks which was a slightly more positive statement than last time when the downside risks were described as ‘substantial’. There were still expectations that the ECB would be prepared to cut interest rates again if the outlook deteriorated. Draghi refused to comment on the issue of Greek bonds, but did broadly welcome news of a Greek debt deal.

Ahead of the Euro-group meeting in Brussels, the Greek government stated that it would accept the conditions for a EUR130bn second loan package to prevent a debt default. The government will still need to find an extra EUR350bn in savings to meet troika demands and will also need rapid parliamentary approval for the measures. Two coalition party members resigned immediately following the deal and there will inevitably be a hostile response within Greece. These uncertainties prevented the Euro from gaining much traction and it again failed to hold above the 1.33 level.

The US jobless claims was better than expected with a decline to 358,000 in the latest week from 373,000 previously, maintaining the recent underlying improvement. The dollar still found it difficult to gain any additional support given the Federal Reserve stance. There was strong demand at the latest Treasury bond auction which suggests underlying confidence in the global outlook may still be very fragile.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support close to the 77.0 area against the yen during Thursday and pushed steadily higher during the US session with a peak near 77.70. The US currency received some support on yield grounds following the latest jobless claims data and strong demand at the bond auction also had a positive impact. The yen was broadly weaker on the crosses as the Euro aimed to break above technical resistance levels.

Finance Minister Azumi again warned over the potential for intervention and there was further caution over yen buying given the threat of stealth intervention. Reduced expectations of a move to the 75 area triggered a scaling back in long yen positions.

There will still be a high degree of caution over the global growth outlook and reservations over selling the yen aggressively, especially after the latest Chinese trade data recorded a downturn in exports and imports.

Sterling

Sterling held above support in the 1.58 area against the dollar ahead of the Bank of England interest rate decision on Thursday. The Monetary Policy Committee (MPC) announced a further GBP50bn increase in quantitative easing while interest rates were unchanged at 0.50% which was broadly in line with market expectations.

In justifying the decision, the bank stated that weak growth was likely to push inflation below the 2.0% target on a two-year horizon and there was market speculation that there had been splits within the MPC. Sterling initially advanced on relief that even larger additional quantitative easing had been resisted before drifting weaker again.

The economic data was mixed as a recovery in December manufacturing output failed to prevent a decline for the quarter while the NIESR estimated that that the economy shrank 0.2% in the three months to January. The UK currency dipped to re-test support near 1.58 as the dollar also gained some relief.

Swiss franc

The dollar found support on dips to just below 0.91 against the franc on Thursday and edged back to the 0.9130 area, although the underlying move was unconvincing. The Euro was able to hold close to 1.21 against the Swiss currency.

The ECB maintained a relatively neutral tone in the interest rate decision and there was relief that some form of Greek deal had been secured. In this environment, there was little immediate reason for a fresh surge in defensive franc buying, although markets will inevitably remain cautious given market uncertainties.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

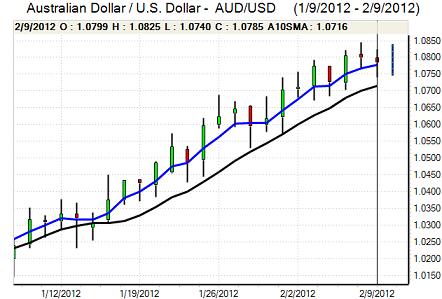

Australian dollar

The Australian dollar again hit resistance above the 1.08 level against the US dollar during Thursday with a peak in the 1.0820 area before a significant retreat in Asian trading on Friday.

The Reserve Bank cut its growth and inflation forecast in its latest monetary report and commented that lower inflation would give scope for further interest rate cuts if required. There were also some concerns surrounding the latest Chinese trade report as a sharp drop in imports increased concerns over a potential hard landing for the economy.