EUR/USD

The Euro found support on dips to the 1.3680 area against the dollar in Europe on Wednesday and maintained a generally firmer tone during the day with a break of resistance in the 1.3750 area triggering renewed demand for the currency.

The Euro-zone economic data did not have a major impact, but there was a stronger than expected reading for industrial orders. ECB officials maintained a generally hawkish tone with President Trichet commenting that the bank would do whatever is necessary to ensure medium-term price stability. There will be further speculation over a shift in ECB language at next week’s meeting which will underpin the Euro.

Degrees of risk appetite remained very important during the day and the US failed to secure any benefit from weaker equity markets, higher oil prices and increased unease over the Libyan situation. There was also weak demand in the latest US Treasury bond auction which suggested defensive demand for Treasuries was limited, but there could be a rapid change in sentiment.

Although the US economic data was slightly stronger than expected with existing home sales rising to an annual rate of 5.36mn from a revised 5.22mn previously, the US currency again failed to gain any support. The Euro peaked close to 1.3780 and held a firm tone in Asian trading on Thursday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar again failed to gain any notable support against the yen during Wednesday and retreated to lows near 82.10 with significant stop-loss selling a feature below 82.50.

The yen gained defensive support from a deterioration in risk appetite and declining global stock markets as increased fears over the Middle East situation triggered an international shift in confidence The yen will continue to gain support when risk aversion increases and there will also be increased fears over global growth prospects if energy prices continue to rise.

There will be the potential for capital repatriation back to Japan during the next month ahead of the fiscal year-end and this will also help underpin the yen. The dollar was trapped close to 82 on Thursday despite some speculation over Finance Ministry verbal intervention.

Sterling

Sterling held firm ahead of the Bank of England MPC minutes during Wednesday with solid support in the 1.6180 area against the dollar. The minutes recorded a 6-3 vote for unchanged rates at the February meeting. As well as Sentence and Weale who had voted for a hike in January, Dale voted to increase rates and Sentence was looking for a 0.50% increase to 1.00%.

The majority preferred to leave rates on hold, but there was certainly greater concern over the inflation outlook and members suggested that rates would be increased if there were signs of firmer growth. There was still a high degree of caution over the outlook for inflation and growth, especially with fiscal tightening taking place this year. Business surveys will be watched very closely to assess whether growth conditions appear to be holding firm.

There will be speculation over a rate increase as early as March which will provide some near-term Sterling support. Potential buying will still be limited by fears over stagflation within the economy and there was selling above 1.6250 against the dollar.

Swiss franc

The franc continued to gain defensive support during Wednesday as fears surrounding North Africa and the Middle East increased. The Euro dipped to test support below 1.28 against the Swiss currency while the dollar retreated further to a record low just below 0.9280.

Safe-haven considerations will remain very important in the near term and the franc appears to have maintained its position as the ultimate safe-haven currency.

The National Bank will be uneasy over the situation and there will be an increased risk of verbal intervention if the franc advances further.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

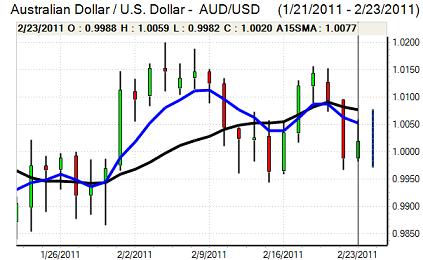

Australian dollar

The Australian dollar initially faltered close to 1.0050 against the US dollar on Wednesday and dipped to lows near 0.9985 before finding fresh support and a move back above parity. The latest investment data recorded a quarterly increase, but was weaker than expected and international influences dominated.

The currency will continue to be hit with conflicting factors and high volatility will remain an important risk. There will be yield support, especially with expectations of a dovish US Fed policy, but the currency will tend to be undermined by a deterioration in risk appetite. There will also tend to be increased selling pressure if high oil prices spark fears over a sharp downturn in the regional economy.