EUR/USD

The Euro found support on dips towards the 1.4150 area in European trading on Tuesday and again pushed to test resistance close to 1.42 with the currency securing a fresh 20-week high above 1.4230 before a consolidation phase.

Comments from ECB officials remained under close scrutiny during the day and President Trichet stated that he had nothing to add to comments made in the March press conference. Fellow member Mersch also repeated that strong vigilance was needed on inflation which suggests that the bank is still planning to raise interest rates at the April council meeting. Markets are now pricing in an increase in rates to 2.25% over the next 12 months with expectations continuing to boost the Euro.

Structural considerations also remained important as EU leaders secured agreement on a EUR500bn stability mechanism from 2013. There was still disagreement on how to increase the existing facility and there was also no agreement that the fund could buy secondary debt which would leave the burden still with the ECB. Portugal’s government faces a parliamentary vote on austerity measures this Wednesday and there will also be tensions ahead of Friday’s EU summit which could trigger fresh volatility.

The US economic data was weaker than expected with existing home sales falling by 9.6% in February to an annual rate of 4.88mn and a reduction in safe-haven support also dampened demand for the US currency. It weakened to a 15-month low on a trade-weighted basis as the technical outlook deteriorated with expectations of low interest rates also still a key negative influence.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar pushed to a high near 81.30 against the yen during Monday, but it was unable to make a serious challenge on resistance levels and retreated back to below 81 in Asian trading on Tuesday. An easing of risk aversion dented defensive yen demand as regional equity markets rallied, but the US currency was unable to take advantage.

There were still expectations of near-term capital repatriation which underpinned the yen. There is also evidence of substantial dollar sell orders above the 82 level which will make it difficult for the US currency to make significant headway.

The G7 intervention threat inevitably remained an important influence even though there was no evidence of yen selling during the day. Japanese sources suggested that further intervention had not been ruled out and there was speculation that the 80 level would be defended strongly, but the dollar remained on the defensive in Asian trading on Tuesday.

Sterling

Sterling resisted a test of support close to 1.62 against the dollar on Monday and moved steadily higher with a 2-week peak above 1.63 as the US currency remained firmly on the defensive. The latest data showed a big reduction in long speculative Sterling positions and the ability to withstand selling pressure suggests that there is firm demand for the currency.

The latest inflation data will be watched closely on Tuesday and a higher than expected reading would increase pressure for the Bank of England to raise interest rates. There will also be caution ahead of two important events on Wednesday when the March Bank of England minutes will be followed by the annual budget.

Sterling will tend to gain support from any improvement in global risk appetite, but there will still be caution surrounding the outlook for consumer spending and the Euro held above 0.87.

Swiss franc

The dollar hit a high of 0.9070 against the franc on Monday, but it was unable to sustain the advanced and drifted back to the 0.9025 area with the Swiss currency also resisting further selling pressure against the Euro.

Safe-haven considerations remained very important for the Swiss currency and the latest speculative positioning data recorded the largest net long franc position for seven years. An easing of fears surrounding the Japanese nuclear situation should curb franc demand to some extent, but caution will still tend to prevail. Comments from National Bank officials will be monitored closely over the next few days to assess whether intervention will be a viable option.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

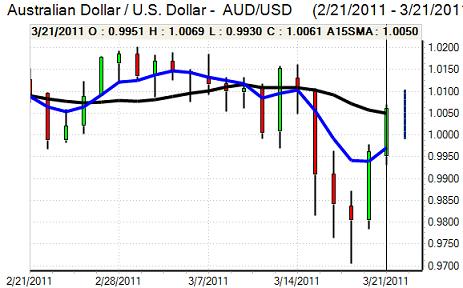

Australian dollar

The Australian dollar found it difficult to make much headway during European trading on Monday, but it resisted any further test of support below parity against the US currency and moved higher to the 1.0080 area in local trading on Tuesday as underlying sentiment improved.

The Australian currency drew support from an improvement in risk appetite as equity markets rallied and there was also support from the high level of commodity prices with coal price a particular area of interest given the sector’s importance. Caution is still liable to prevail given regional economic uncertainty.