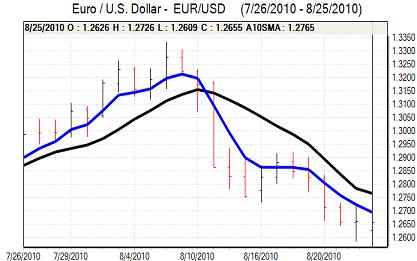

EUR/USD

The Euro attempted a technical recovery in European trading on Wednesday with a challenge on resistance levels above 1.27 against the dollar. The currency looked to correct higher after recent sharp losses and also drew support from a stronger than expected reading for the German IFO index. The recent Euro-zone data has continued to suggest resilience, especially in the key German economy and this is providing some Euro support.

Structural fears are also still a very important factor and there are growing fears over a fresh round of debt default fears, especially after ECB suggestions that extra liquidity will be needed and the Euro quickly retreated back to the 1.26 area.

The US economic data maintained the recent very weak run with new home sales falling by 12.4% for July to a record low annualised rate of 276,000. Following the very weak existing home sales data, a disappointing reading was likely. There will, however, be greater concern over the durable goods data which recorded a much weaker than expected 0.3% gain for July while core orders fell 3.8%. The industrial sector has been able to provide firm support during 2010 and there will be fears that this sector is now looking vulnerable. In particular, there will be concern over a sharp decline in core capital goods spending.

Although the data will increase fears over the global economy and maintain a defensive attitude towards risk appetite which will help underpin the dollar, there will also be continuing fears over the US economy and pressure for a further expansion of quantitative easing. The US currency had a generally weaker tone and the Euro recovered back towards 1.27 during Thursday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar resisted a further test of support below 84 against the yen during Thursday with further speculation that there would be intervention to weaken the Japanese currency.

There have been hints over possible action by the Finance Ministry while the Bank of Japan has indicated that it will look at fresh measures to boost the money supply. While markets continue to fret over the possibility of intervention, there will certainly be a reluctance to sell the yen, but pressure on the dollar could build quickly if there is no action.

Trends in risk appetite will also remain very important and the yen will continue to gain defensive support from a lack of confidence in the US and Euro-zone economies. The dollar nudged higher in Asian trading on Wednesday, but has not been able to break back above the 85 level.

Sterling

Sterling found further support below 1.54 against the dollar over the past 24 hours and advanced to the 1.5550 area in Asian trading on Thursday with Sterling also underpinned against the Euro. There have been reports of central bank interest in Sterling at lower levels which has helped to toughen support levels.

There have been no major domestic economic releases to help guide markets and it is still the case that underlying confidence in the UK economy is liable to weaken.

A key factor for Sterling is that there will be very little confidence in the US and Euro-zone outlook. In this environment, there should be protection for the UK currency despite the persistent domestic fears.

Sterling will be much more vulnerable to selling pressure if there is any evidence of renewed stresses in the UK banking sector.

Swiss franc

After hitting fresh record lows below 1.30 against the franc, the Euro found some support and rallied back to the 1.31 area on Thursday. Technically, the Euro needed to correct after heavy recent losses and there will be doubts whether the recovery has firm foundations.

Underlying support for the Swiss currency remains firm on defensive grounds and confidence in the global economy is likely to remain generally weak.

National Bank Chairman Hildebrand stated that the bank would only take action against franc strength if deflation fears returned and this will tend to limit franc selling. The dollar found support below 1.0280, but has struggled to secure much of a recovery.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

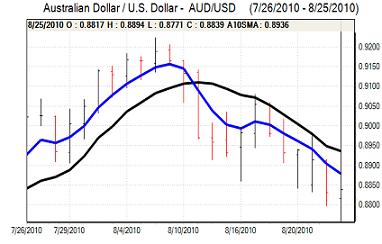

Australian dollar

The Australian dollar was subjected to fresh selling pressure in European trading on Wednesday with a test of support below the 0.88 level against the US currency. The currency was inevitably undermined by weak risk appetite and fears over the global economy.

A tentative rally in global stock markets did provide some degree of relief and the Australian currency rallied to the 0.8860 region on Thursday. Persistent caution over the global economy will make it very difficult for the Australian currency to make much headway.