EUR/USD

The Euro maintained a weaker tone in early Europe on Tuesday with lows close to 1.27 against the dollar as structural fears remained dominant. There was continuing selling pressure on the Euro in options markets which suggests that underlying confidence in the currency could have deteriorated further despite the support package this week.

The pattern of market fears was similar to that seen during the second half of Monday with Euro-zone officials unable to secure a sustained improvement in confidence. There were persistent fears that the Euro-zone countries would not be able to deliver the budget cuts and reduce the deficits to sustainable levels.

In parallel to these doubts, there were also fears that the fiscal tightening would further undermine growth and undermine sentiment. Weakness in economies would make it even more difficult to cut budget deficits and there were also expectations that the ECB would maintain very low interest rates for a longer period of time. There will also be speculation that Euro-zone member will prefer a weaker Euro to help underpin growth prospects.

The US economic data did not have a significant impact with a small rise in a reading of consumer confidence. There was a further increase in Libor rates during the day which illustrates that there are still important liquidity issues. In this environment, selling pressure on the dollar is liable to be limited.

The Euro was unable to regain the 1.2750 level and re-tested support levels below 1.27 during US trading.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The pattern of caution continued on Tuesday with lower commodity prices also tending to discourage carry trades and will tend to curb selling pressure on the Japanese currency with reduced flows into currencies such as the Australian dollar.

There was some further speculation that the Chinese authorities will move to widen the yuan trading band and this should underpin the yen to some extent, although the direct impact may be limited. The dollar weakened back to the 92.65 area against the yen during Asian trading.

The US currency dipped further to test lows near 92.20 against the yen, but found support close to this level and moved back to 92.70 as there was still interest in selling the Japanese currency on rallies.

Sterling

Sterling was generally on the defensive in early Europe on Tuesday and tested support levels below 1.48 against the dollar. The UK industrial data was substantially stronger than expected with a 2.0% increase in production for March which triggered an initial bounce in the UK currency.

Thereafter, political developments tended to dominate and Sterling gained some support once it appeared less likely that there would be a Labour-Liberal Democrat coalition. Sterling continued to rally as the Labour government formally resigned with a new coalition led by the Conservatives set to take office. Sterling rallied to near 1.50 against the dollar before correcting back to 1.4950 while Sterling tested Euro support levels below 0.85, the strongest UK currency level for 10 months.

Attention will also now tend to switch to the economic situation. Markets will be looking very closely at comments and policy statements on the government-debt situation and the potential pace of spending cuts.

The Bank of England inflation report will also be watched very closely on Wednesday for further evidence on economic trends and a downgrading of growth prospects would tend to undermine Sterling.

Swiss franc

The dollar found support on dips to the 1.1025 level against the Swiss franc on Tuesday and rallied to the 1.1130 region before consolidating around the 1.11 area. The Euro was put under renewed pressure against the Swiss franc and dipped to below the 1.41 level.

The persistent lack of confidence in Euro-zone countries and the Euro remained an important supportive factor for the Swiss currency.

There was a rise in Swiss consumer confidence and there will be further expectations that the Swiss economy will out-perform the Euro area which will maintain underlying franc support.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

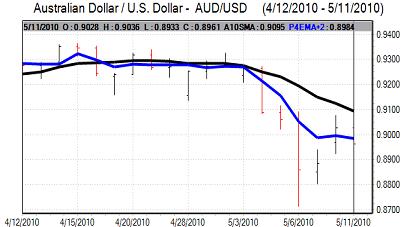

Australian dollar

The Australian dollar was unable to make much progress above the 0.90 level and retreated to lows near 0.8930 before steadying near the middle of the day’s range.

Risk appetite is likely to remain generally weaker in the short term which will curb Australian dollar buying support, especially with doubts over the Chinese economic performance. Any decline in commodity prices would tend to put further downward pressure on the Australian currency.