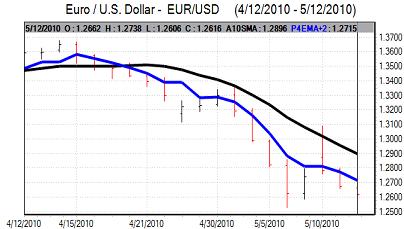

EUR/USD

The Euro remained under pressure in early Europe on Wednesday and tested support levels close to 1.26 against the dollar. German GDP rose 0.2% in the first quarter which was slightly stronger than expected while the GDP data for the Euro-zone as a whole was marginally firmer than expected at 0.2%. The economic data continued to have only a limited impact as structural uncertainties remained the dominant focus.

The Spanish government announced that there would be additional spending cuts in order to reduce the budget deficit to 6% of GDP in 2 years time from around 11.2% this year. The deficit-reduction plans maintained fears that Euro-zone demand would remain very weak over the next year. In turn, there will be continuing expectations that the ECB will have to maintain a policy of very low interest rates which will tend to sap Euro support.

There were also still underlying fears that the latest support package would not be sufficient to prevent medium-term debt restructuring. There was also further speculation that from a longer-term perspective the Euro was over-valued at current levels.

The US trade deficit widened to a 15-month high of US$40.4bn for March, but the overall impact was limited as markets remained focussed elsewhere. Dollar Libor rates continue to edge slightly higher which maintained some fears over liquidity stresses and provided some dollar support. The Euro was unable to regain the 1.27 level and weakened back to near 1.36 late in US trading.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Market forces were more balanced during Asian trading on Wednesday with some improvement in risk appetite offset by persistent doubts over the underlying situation. There was also unease over the situation surrounding China with several influential commentators voicing concerns over the risk of a sharp slowdown in the economy.

There was also a decline in the Nikkei index which stifled selling pressure on the Japanese currency. The dollar was unable to strengthen above the 93 resistance area and consolidated again in the 92.65 area with relatively narrow ranges.

Risk appetite was generally firmer in US trading on Wednesday and this allowed dollar gains to the 93.25 area where resistance levels remained firm.

Sterling

The UK unemployment data again recorded a bigger than expected decline in the claimant count of 27,100 for April after a decline of over 30,000 for March although the labour-market data again indicated a rise in unemployment.

The new UK coalition government appointed Ministers during the day and there was still a mood of relief over the prospect of near-term political stability and an ending of uncertainty.

In its latest inflation report, the Bank of England stated that there were downside risks to the economy while there was still a high degree of excess capacity in the economy. The bank also stated that inflation was likely to be below the 2.0% level in two years time if interest rates moved in line with market expectations.

Bank Governor King welcomed the government plans to tighten fiscal policy at a faster rate and there will also be expectations that the bank will keep interest rates at a very low level in order to compensate for the fiscal tightening.

The UK currency again hit selling pressure above 1.50 against the dollar and weakened to lows near 1.4820 on the prospect of fiscal tightening. The Euro regained the 0.85 level, but struggled to make much headway.

Swiss franc

The dollar found support on dips towards the 1.1050 level on Wednesday and pushed to a high of 1.1140 in US trading as ranges remained slightly narrower. The Euro remained firmly on the defensive against the franc and dipped to test support levels close to 1.4020 as Euro confidence remained very weak.

The Swiss economic data remained generally firm with an annual increase of 0.8% for producer prices in the year to April. With firm readings for business and consumer confidence there will be further expectations that the bank will decide against blocking franc gains.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

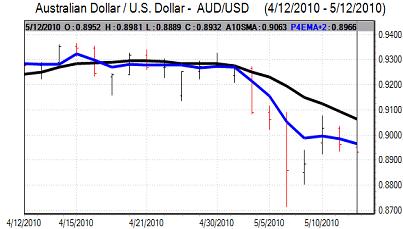

Australian dollar

The Australian dollar steadied above the 0.89 level against the US dollar on Wednesday, but buying support was limited with a peak below the 0.8980 level.

The domestic home loans data was again weaker than expected and will trigger some doubts over the economy. International trends are still likely to dominate and there is likely to be a more cautious attitude towards risk which will curb Australian dollar buying support.

The Australian dollar retreated back to the 0.8920 area later in US trading.