EUR/USD

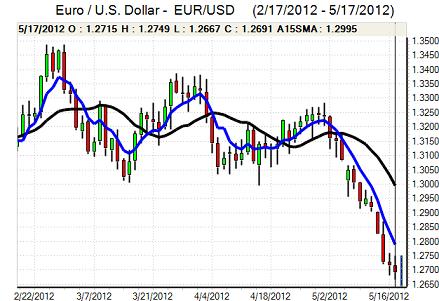

The Euro hit resistance close to 1.2750 against the dollar during Thursday and remained under pressure during the European session. There were further fears surrounding the European banking sector which had an important negative impact on the currency. There were reports of substantial capital withdrawals from the Greek banking sector and there were also reports of substantial outflows from Spanish bank Bankia. The shares retreated very heavily during the session which also undermined wider confidence as fear dominated.

There were fears that a general flow of funds out of the banking sector would make it even more difficult to stabilise conditions in the Euro-zone area. There were also substantial fears surrounding a Greek exit from the Euro-zone and the potential contagion implications, especially given major fears surrounding the financial sector.

There was intense pressure for the ECB to take additional action to stabilise markets while the political pressure for additional measures was also intense. German Finance Minister Schauble called for a rapid move to political union and underlying tensions remained high.

The US latest jobless claims data was broadly in line with expectations, unchanged at 370,000 in the latest week. In contrast, there was a much weaker than expected reading for the Philadelphia Fed index as it dipped to -5.8 from 8.5 the previous month while there was a substantial deterioration in most of the major components which raised some doubts over the US outlook.

The Euro tried to stabilise just above 1.27, but it was unable to make any significant impression and was subjected to renewed selling later in the US session following the rating downgrade of 16 Spanish banks while Fitch also downgraded Greece’s sovereign rating to CCC from B-. In this environment, the Euro retreated to fresh 4-month lows near 1.2660. There will be pressure for weekend action at the G8 meeting with volatility likely to remain very high.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was blocked below the 80.50 level against the yen on Thursday and edged towards the 80 level ahead of the US open.

The dollar lost support following the weaker than expected Philadelphia Fed index and a break below 80 triggered further stop-loss selling on the US currency. Selling pressure also accelerated after a slide to below the 79.50 level.

A lack of confidence in the Euro-zone and weak demand for the US dollar increased defensive demand for the Japanese currency, especially after better than expected GDP data. The government also increased its assessment of the Japanese economy which provided some support. Risk conditions remained very fragile during Asian trading on Friday which pushed the dollar to lows near 79.25.

Sterling

Sterling was unable to make any significant headway above 1.59 against the dollar on Thursday and retreated steadily to lows just below 1.58 before finding some degree of support.

The scope for defensive UK support was illustrated by the latest two-year bond auction as yields fell sharply to 0.35% as bidding interest remained strong. Sterling was, however, unable to make any fresh progress against the Euro and retreated back through the 0.80 level which suggested underlying selling pressure from the corporate sector while valuation factors also held back the currency.

There was further speculation that the Bank of England could sanction additional quantitative easing within the next two months. MPC member Fisher did state that further bond purchases would be unlikely unless there was the threat of deep recession. There was increased unease surrounding the domestic economy, especially given the fears over weak European demand.

Risk conditions remained very important and an increase in fear put Sterling under pressure as it fell to two-month lows of 1.5750 in Asia on Friday.

Swiss franc

The dollar pushed to highs around 0.9480 against the franc on Thursday before retreating back to the 0.9450 region as the Euro remained pinned to the 1.2010 region with renewed defensive demand for the franc.

Safe-haven considerations inevitably remained very important during the day, especially with increased fears surrounding the Euro-zone banking sector. There will be scepticism whether the National Bank will maintain its commitment to the 1.20 minimum level, especially as the required intervention to prevent franc appreciation may well have to increase.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar was unable to move significantly above the 0.9950 level against the US dollar on Thursday and did test support below 0.99, but it did prove to be relatively resilient during the day as corporate demand for the currency increased.

Risk appetite was still generally fragile which limited the scope for any significant recovery. Confidence deteriorated again during the Asian session on Friday and the Australian dollar was subjected to renewed heavy selling pressure with six-month lows around the 0.9820 level as regional equity markets were subjected to renewed selling.