EUR/USD

The Euro was able to secure a steadier tone during Thursday as there was a decline in Italian yields and markets were able to take a slightly more measured tone surrounding the Euro-zone crisis.

There was sufficient demand at the latest Italian auction even though yields increased to a 14-year high and rose sharply from the previous sale in October. There were also suspicions that demand had been influenced strongly by the ECB even though action should be confined to the secondary markets according to the SMP.

The longer-term implications and policy responses continuing to be debated intensely given that Italian yields remain at unsustainable levels even with a daily decline. There was further strong rhetoric from ECB and Bundesbank officials opposing any extension of the ECB bond-buying programme. Officials, including Eurogroup Head Juncker, continued to insist that there could be no expulsions from the Euro area, but this did little to stem market speculation.

There were further concerns surrounding the Euro-zone economy as the EU Commission cut the 2012 growth outlook sharply to 0.5% from 1.8% previously.

The Greek President announced that a new government would be sworn in on Friday under Papademos and there was a commitment to maintaining the austerity programme, although confidence was inevitably very fragile, especially after the protracted delays in forming an administration.

The US economic data was slightly better than expected with jobless claims falling to 390,000 in the latest week from a revised 400,000 previously while there was a narrower than expected trade deficit of US$43.1bn for September from US$44.9bn as exports pushed to record levels. The data will maintain a slightly more optimistic tone towards the US economy.

Defensive considerations will remain extremely important and there will be dollar demand on fears over the Euro-zone and global economy. Fears surrounding emerging markets could be particularly important in supporting the dollar. The Euro strengthened to the 1.3650 area and consolidated just above 1.36 after falling on rumours of a French Sovereign downgrade by Moody’s.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to make any impression on the yen during Thursday and retreated back to test support in the 77.50 area despite slightly stronger than expected US data with yen selling still limited.

Overall confidence surrounding the global economy and risk appetite remains extremely fragile and this is maintaining defensive demand for the yen, especially with a lack of viable alternatives. Official comments on the yen will continue to be watched closely given the possibility of renewed intervention and these fears will certainly tend to slow any yen advance.

The Japanese economic data was weaker than expected with a decline in the services sector for October and a lower reading for wholesale price inflation, although the impact was limited.

Sterling

Sterling initially found support near 1.59 against the dollar on Thursday and pushed higher following the BOE decision, but it was unable to break back above 1.60 and there was a temporary break of support below 1.59 as the UK currency was unable to sustain a move beyond 0.85 against the Euro.

The Bank of England left interest rates unchanged at 0.50% following the latest policy meeting and also left quantitative easing on hold at GBP275bn. There will inevitably have been a lengthy discussion on the dangers posed by Euro-zone weakness, but markets will have to wait for the minutes to discover whether any members proposed additional stimulus at this time.

There was still some evidence of defensive flows into Sterling as UK bond yields remained at extremely low levels in historic terms. There will still be concerns that banking-sector assets could be withdrawn to help underpin European balance sheets and this could expose Sterling to heavy selling pressure if market sentiment shifts.

Swiss franc

The dollar was unable to hold above 0.91 against the franc on Thursday , but did find support on dips towards 0.90 as underlying selling pressure was contained. The Euro was able to secure a steadier tone against the Swiss currency with support close to 1.23.

There was further pressure from domestic companies regarding the strength of the currency. Although media debate surrounding a lifting of the Euro minimum level subsided slightly, it will remain an extremely important market issue, especially as a further downturn in the Euro-zone economy would cause further damage to Swiss industry and increase competitiveness fears.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

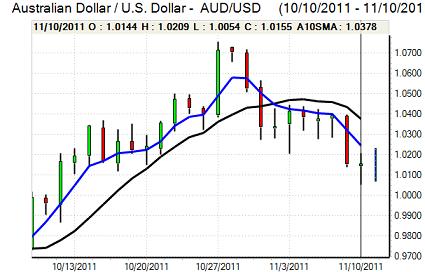

Australian dollar

The Australian dollar found support below 1.01 against the US currency on Thursday and rallied to a peak above 1.02 before finding fresh selling pressure. There was some steadying in international risk appetite which helped curb selling pressure on the local currency even though the underlying mood remained extremely cautious.

The banking sector will remain an extremely important focus as any downturn in regional lending could have an important negative impact on the Australian economy and currency.