As evidenced in The Complete Guide to Option Selling (McGraw-Hill 2009), we are big advocates of trading with the trend when possible. We are bigger advocates of trading with a fundamentally supported trend.

The other side of the coin is that in mature trends with fundamental forces that do not support it’s continuation, selling against the trend can be an exceptional strategy for collecting deep out of the money, overpriced options – especially in markets that have already made big moves. Why? Two reasons.

1. Because fundamentals are the fuel for any long term trend. When they begin to change, the trend tends to follow.

2. Because when markets are trending, option buyers tend to buy options out in front of the trend. This is especially true in uptrends. The public tends to

be innately bullish. This is why call options the same distance out of the money tend to be worth more than put options – most of the time.

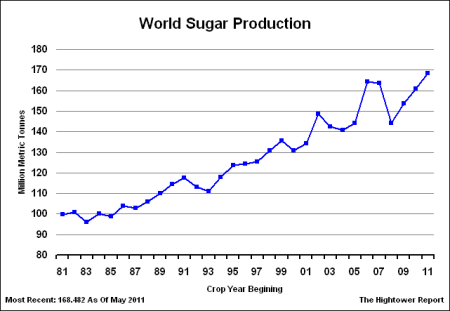

Sugar is the perfect example of a commodity in a mature price trend that is in the midst of shifting fundamentals.

OCTOBER 2011 SUGAR

Sugar prices have steadily climbed since early May when concerns about delays in the Brazilian cane harvest along with a production deficit from 2010 brought speculative buying interest back to prices.

I have heard many analysts quote the “need” for a bumper sugar harvest this year. It now appears that these analysts will get their wish.

Hefty Production Ahead

The delays of new crop sugar have not been so much in the harvest, but do to some short term shipping issues out of Brazil and other key world exporter Thailand. It is true that Brazil’s rate of harvest is behind last year, down nearly 25% from this time last year. But last year’s harvest started early. By historical standards, this year’s harvest is rate is not far from average.

The eventual total yield however, is expected to be a whopper. Brazil is expected to harvest 39.6 million metric tons (mmt) of sugar in 2011 – a new all time record. Thailand produced 9.62 mmt this year, also a new all time record. India is expected to produce 4 to 6 million tons of sugar over and above their domestic consumption – meaning India will be exporting more sugar this year.

The world will produce a record amount of Sugar in 2011 – resulting in a global production surplus.

The key stat here is this: As a result of increased sugar production and a slight drop off in demand, the world will go from a global sugar production deficit of 447,000 mmt for the 2010/11 crop year to a nearly 9 million ton Sugar supply surplus for the 2011/2012 crop year.

We often hear in commodities that the cure for high prices is high prices. I would add to that list that another cure for high prices is a mammoth surge in supply. Investing with these kinds of fundamentals is a cornerstone of our strategy.

Your Profit Strategy

We do not recommend trying to pick a top in this market because we don’t know where or when that will be. New crop sugar is just starting to trickle out of Brazil and it will likely be a few more months before the new supply stream starts to flow in earnest. That being said, as option sellers, we don’t have to pick tops.

The Sugar Cane harvest is off to a slow start in Brazil. However, the ultimate result should be a record crop.

It is our opinion that the high in this market was made back in February and calls sold above those levels should be excellent premium collections for investors. Despite the current speculator buying, sugar traders are well aware of the incoming supply in the coming months. Whether it be sooner or later, the focus will shift from short term tightness to longer term abundance. And prices will almost certainly have to adjust lower.

There are still opportunities to sell calls in the October contract on rally days. These options should benefit from relatively quick time decay. However, the pure fundamental play is in the March contract as new record supplies will be fully reflected in this contract. The later we get in the year, the more impact these new supplies will have on price.

Sellers of the March calls will also benefit from deeper out of the money strikes. Profits could potentially be taken as early as October or November.

We will be workly closely with our managed accounts this month in selecting the optimum strikes in the Sugar market.

If you are interested in getting started with your Option Selling Account this month, call 800-346-1949 (813-472-5760 international). New client membership is limited and waiting list may apply.